What are the Examples of Fintech?

Thursday, April 07, 2022

Fintech empowers the world with new-edge solutions for you to use apps to check your balance, seamless transactions instantly and other vital services. Individuals or companies using fintech can do anything from tax calculations to the evaluation of the market, without the need for any prior financial experience.

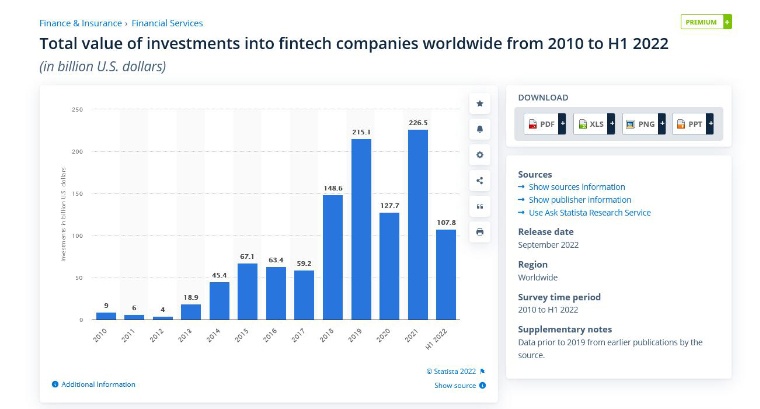

Have a look at the below-mentioned image that shows the total value of investments into fintech companies across the world from 2010 to 2022:

Fintech performs a variety of special operations like payment processing, transactions on eCommerce websites, automatic bookkeeping, and other programs that support the financial process of the country securely. If we follow the COVID-19 pandemic, numerous firms are turning to fintech to offer features such as contactless mobile payments, UPI options, and other tech-driven transactions. So, now that you are completely aware of how fintech works, this blog is a reminder for all those who don’t know how Fintech works and what are its examples.

1. What is Fintech?

Fintech is a phrase that combines finance and technology and offers almost all types of financial services from businesses to consumers. Fintech refers to any business that is capable of offering financial services via software development or other technology, which might range from apps for mobile payments to bitcoins and cryptocurrency.

As we know Fintech is a large umbrella term that covers and connects with almost all types of financial services via the internet, mobile devices, software, or cloud services. Many fintech products aim to link customers’ finances to technology for ease of use, but the term can also refer to business-to-business (B2B) solutions. Fintech originally referred to the technology used in banks or other financial organizations’ back-end systems, but it has subsequently expanded to include a wide range of other uses.

Numerous custom applications are developed for businesses to make use of financial technologies wisely. We must see how each of these leading technologies is all set to make a difference for companies.

Here are the main reasons why consumers use Fintech:

2. Leading Fintech Examples

Here are the examples of fintech

2.1 Digital Lending and Credit

According to Ken Research, the digital lending market is evolving over the past few years with the entrance of major digital lending players in the market.

Today’s global economy is completely dependent on payments and payment-based applications. Many stakeholders are playing an active part in the development process like issuers, payments, processors, networks, and merchant acquirers are all heavily investing in shaping or advancing their payment systems. They leverage multiple advancements in technology to match industry-specific customer preferences and business requirements. Banks gain a lot from digitalization with the lending process in a variety of ways. This can include enhanced decision-making, improved client experience, and significant cost savings. It’s also a difficult and time-consuming task.

Digital lending is a technology that enables financial organizations to increase production and loan profits while also improving service at the point of sale (POS). It allows potential borrowers to apply for loan products from anywhere in the world using any internet-capable device.

Digital lending is not a new or unfamiliar practice, and financial institutions are well-versed in the fundamental premise. That idea, though, is becoming more complex as technology innovates and the needs of customers get modified. Customers want banks to process applications quickly and make decisions quickly. Ordinary paperless services are now normal, and traditional banking institutions must keep up by offering customers digital financing methods that go beyond the norm.

2.2 Crowdfunding Platforms

Crowdfunding is a process of Crowdfunding is the technique of raising money from a large number of people or organizations to sponsor a new project. Crowdsourcing platforms allow users to send and receive money from others on the platform, allowing individuals or corporations to aggregate funds from a range of sources in one area. Instead of going to a typical bank for a loan, a project or company can now go straight to investors for funding. Crowdfunders frequently use social media to promote their platform or idea to encourage people to contribute to the crowdfunding campaign.

There is a consistent back-and-forth process between entrepreneurs and investors. This is eliminated with the use of crowdfunding. Rather than waiting for an opportunity to present their product concept to a group of investors, entrepreneurs can take their offer to the general public and seek funding from those who are interested.

The number of crowdfunding platforms has grown over time, with applications ranging from family and friend fundraising to fan and patron funding.

2.3 Mobile Banking

In the year 2021, the Global Mobile Banking Market is valued at USD 692.5 Million which is expected to reach a value of USD 1,359.5 Million by the end of 2028. The Global Market is expected to reach a Compound Annual Growth Rate (CAGR) of more than 10% over the forecast period. One of the most prominent and probably most widely used financial technology is mobile banking. Mobile banking apps can alert you whenever you are going extra, like spending more money than you should or have in your account. It is driven in a way that turns the account into savings on payday and allows you to establish spending limits on the cards. The app is designed in a way that it can send you fraud alerts, and let you call a customer service representative by touching a button in a bank app. It can also let you transfer an amount to your pal. Customer service and support are provided by the best mobile banking apps via self-help, phone, live chat, and/or other channels. Nowadays, financial institutions are continuously growing and evolving their mobile banking capabilities by keeping up with the latest consumer needs.

In this regard, multi-factor authentication with safe sign-in options with bank account details and current technologies like biometrics, fingerprint readers, facial recognition, codes, and more make the sign-in process easier. Users should be able to have a safe mobile experience by using mobile apps that provide the highest level of security. Customers will be able to contact the institutions more easily if they have any problems or questions. Customers would undoubtedly want assurance that their personal information is well-protected.

Another must-have feature is the ability to make digital payments, which may be at the top of most customers’ wishlists. In this paperless era, every mobile banking app should provide quick access to many digital payment alternatives, mobile wallets, UPI, and other services.

2.4 RegTech

Here we can see that RegTech companies raised $13.5bn across 320 deals in the first nine months which is driven by large transactions of more than $100m, have a look:

It was the year 2008, the year of the financial crunch, and that’s when the financial world was in disarray. Lehman Brothers had collapsed, Fannie Mae and Freddie Mac had been taken over by the government, and money-market funds had gone bankrupt. Nothing was there on point to get backed on. So to revive the public’s trust a new technological advancement called ‘RegTech’. It was born to address issues relating to money laundering, compliance and managing regulations directives in the financial sector, terrorists’ financial rights/regulations, and much more. They designed a product that uses big data, artificial intelligence, cloud computing, and SaaS technology to help companies abide by regulations efficiently and in a less expensive fashion. RegTech assists Financial Institutions in improving risk management by studying patterns and managing massive amounts of financial data. A RegTech solution ensures that a company’s regulations and compliance procedures are kept up to date.

2.5 Robo-Advising and Stock-Trading Apps

Heard of a bot assisting you via telephonic IVR or guiding you on a website for what you want on the website or from the company? Yes, they are bots, in short, that do Robo-advising for customers. In effect, Robo-advising has increased portfolio management’s efficiency while also cutting costs. Financial advisers may now evaluate many portfolio possibilities more quickly and efficiently, 24 hours a day, seven days a week. There is nothing as surprising as seeing that a large number of Robo-advice providers have suddenly started to offer services.

As we all know, Robo-advisors are digital platforms that provide the best automated and algorithm-driven financial planning services as shown in the picture:

The asset management industry has been changed by Robo-advising. Smart algorithm technology is used by this unique fintech business to deliver intuitive asset suggestions. The introduction of stock-trading apps is another popular and highly inventive fintech contribution.

Previously, investors had to physically visit stock exchanges to buy and sell equities. Investors may now trade stocks with the touch of a finger on their cellphones, thanks to stock trading tools. Investing has never been easier, thanks to the availability of low-cost and low-minimum stock-trading apps.

2.6 Blockchain and Cryptocurrency

The most common meaning of blockchain is that it is a decentralized, distributed ledger that keeps track of all the records and maintains their digital assets.This distributed digital ledger Technology (DLT) makes the background of the digital asset area as unmodifiable, secure and transparent.

Now you must be wondering, how using DLT benefits digital currencies, isn’t it? So, have a look at the tweet mentioned-below:

See, How Blockchain Works

One of the best analogies to understanding blockchain technology is a Google Doc. Do you know how google Docs functions, it allows you to create a document and share it with a group of individuals. Instead of working hard in making duplicates of the same file or transferring, the document can get corrupted due to multiple access needs or even disseminated. This provides a decentralized distribution chain in which everyone has always and simultaneously has access to the document. Similar is the case with Blockchain. There is a serial number attached to each block of the chain. None of the blocks can be easily accessed even if they have the key of the first and next blocks, still, the blockchain will not allow breaching any information from any of the blocks. Nobody should shut down the changes when another party needs to make a change in the document, and all modifications are tracked in real-time, making them completely transparent.

Cryptography is used to safeguard transactions in any type of currency that exists digitally or electronically. Cryptocurrencies lack a central issuing or regulating authority, instead relying on a decentralized system to track transactions and create new units.

A Cryptocurrency is a digital currency designed to function as a medium to exchange and create through a computer network that is not incidental to any central authority to uphold or maintain it. We can use encryption techniques to control the formation of monetary units and to verify the exchange of funds. Bitcoin is one of the best examples of Cryptocurrency

Cryptocurrency has no intrinsic value, no physical form, and its supply is not determined by a central bank because the network is completely decentralized.

Cryptocurrency is a type of digital currency that does not rely on banks to validate transactions. It’s a peer-to-peer payment system that allows anyone to send and receive money from anywhere. Cryptocurrency payments only exist for digital inputs to an online database describing specific transactions, rather than being tangible. The transactions of money can be traded in the real world. The public ledger is used to record the transactions, the moment you move cryptocurrency funds and for digital wallets, cryptocurrency values can be used.

2.7 Payments

Payments have a different meaning now as it not just revolves around bank transactions but it is much more than that. Sending and receiving payments is one of the most convenient aspects of Fintech. You as a business can do everything using the functionalities of fintech. When you use cryptocurrency, electronic money transfer, or other methods to conduct a transaction between two people is considered a payment.

Payments have been transformed thanks to the latest innovations in online payment gateways, which have made them more simple, easy, fast, and more accessible. Payment gateways have eliminated the need for a bank to be involved in digital financial transactions.

Payment gateways have provided consumers with significant benefits and savings by eliminating costly bank fees.

Mobile payment has evolved into one of our most basic needs. Mobile payments have also had an impact on currency exchange rates. Many small and mid-sized firms had to contend with unfavorable currency rates before the emergence of Fintech.

2.8 Insurtech

Here’s what Grandviewresearch.com observed about the Insurtech Market in the US.

Insurance and fintech coming together form Insurtech. Fintech firms are collaborating with traditional insurance firms to automate the entire process, allowing them to increase claim coverage. Insurtech is a technology developed in the insurance industry to maximize savings and efficiency using industry-based insurance models. Insurtechs are consistently improving the user experience in a variety of ways, including reinventing long processes, claims to process, and frequent activation. Insurtechs, in particular, enable businesses to provide customized insurance services while also ensuring data security. It streamlines the insurance process by allowing users to file claims and manage policies online.

3. Closing Words

The finance sector is overwhelmed with technology advancements, it has everyday innovation making a difference in their process. In summary, Fintech and its diversified advancements have made the entire finance fraternity process data and financial information smoothly and securely. All of these advanced applications are also focused on identifying flaws and eliminating them so that the results are more accurate, secure, and reliable. Fintech innovations have made the overall process less painstaking and more fruitful. If you are a business that hasn’t tried its hands on fintech, then there is so much you are missing out on, trust the industry innovation and take up the benefits of the aforementioned fintech examples.

View Comments

We all know that fintech is fastly growing industry by leveraging technology to offer innovative solutions that make life easier, faster, more secure, and more convenient. Some of the most popular examples of fintech include mobile payment apps like PayPal, investment platforms like Robinhood, and digital banks like Ally. Thank you for sharing this information.

I am grateful for the convenience that fintech has brought into my life. I can quickly monitor my money and conduct transactions anywhere with just a few touches on my phone. Fintech really does make life simpler and more effective!

As a tester, I am aware of the significance of an effective QA process. We can avoid potential issues from affecting end users and ensure an outstanding user experience by thoroughly testing software and spotting problems early on. A robust product and higher levels of customer satisfaction are the results of an effectively run QA process.

Just came across many articles on fintech examples. This article is very informative for me. It would be great if you could include some examples of fintech companies and some fintech products. You could also discuss how fintech will change or impact the financial industry.