Many Fintech companies are flourishing with technological innovation, and newer ideas are being developed into apps. Now, the role of the Fintech industry has become more defined, reasonable, and vital. If you think you can’t keep up with all financial buzzwords from Ethereum, and Bitcoin to NFTs, then don’t panic, you are not the only one. The ever-growing spur of Fintech has been continuously innovating to develop customized financial software solutions. Everything you do, even the smallest financial transaction highly defines the value of fintech within businesses.

Fintech cannot be taken as just another trend, it is here to stay, innovate, and change the current way of operations. Thus, we must have a good understanding of financial services, mobile payments, online trading, mobile banking, payment methodologies, third-party app integration, secure payment services, and similar other needs. Don’t be afraid, you will get to know about each of these in this blog. But first, let us start with the basic question- what is Fintech?

1. What is Fintech (Financial Technology)?

Everything right from mobile banking apps to mobile payments apps, blockchain, cryptocurrency, stock trading, etc can be included in this fintech innovation. Simply put, every business can use fintech for their services to enhance or automate their work and procedures. Wondering why? Because with this you can simply offer exclusive financial services to both businesses and consumers at once.

Fintech is a phrase that’s not a short-term buzzword whose importance can be denied. Over a few years, a radical change has been observed in the way we manage our business and even personal finance – all thanks to the ever-growing financial technology company.

Along with this, more and more fintech(financial technology) companies are emerging, aiming to make financial services more accessible to the general public. Everything from traditional financial transactions, such as investing, savings accounts, and loan processing, are also included in these digital financial services. Take a look at the CNBC report on Fintech.

In layman’s language, this one seems to be now making a million-dollar industry. With this, we can assume that fintech as a service is quite a powerful and money-minting financial services industry if you know how to take the lead. Also, you are halfway done when you realize and act upon utilizing the best from the Fintech companies.

1.1 How Does FinTech Work?

Traditional financial services are available to consumers and companies through fintech in ways that were not possible before. For example, the mobile applications of many traditional banks now offer convenient on-the-go access to a variety of banking functions. Such as checking account balances, transferring payments, and even depositing checks.

Several services used by organizations are made easier thanks to automation enabled by FinTech. Fintech companies can better understand their clients because of the combination of artificial intelligence and large amounts of consumer data, which fuels marketing, product design, and underwriting.

1.2 Companies Using Financial Technologies

A few of the most prominent names in financial technology are included below.

- Plaid: Customers and companies both can use Plaid to securely link their bank accounts and other financial data without revealing their real account details. The usage of Plaid to process transactions is widespread among other fintech companies.

- Wealthsimple: With the help of its robo-advisor, Wealthsimple simplifies the investing process by taking customer input and using it to create diverse portfolios that fit their needs.

- Likewise: Likewise, Brigit is an app that promotes secured financial management by providing its users with features like centralized account access, interest-free cash advances, automatic notifications, and budgeting tools.

2. Why is Fintech Important in the Business World?

Businesses are no longer limited to conventional methods, all thanks to the fintech revolution. Today individuals are surrounded by many alternatives including crowdsourcing, online banking, and mobile payments. More or less, unlike earlier, now anyone can set up their own business quickly with the help of fintech.

By using financial services anyone can create instant plans on how and, most importantly where to secure funding. Here, you don’t need to meet others in person. Instead of spending so much time convincing your investors today, businesses can pitch their ideas seamlessly.

Let’s explore why fintech is important.

2.1 Cost-Effective

Of course, you are well-versed in the fact that global payment services have been a significant benefit for many communities. However, it is important to note that global remittance is a costly venture, and only some businesses have the potential to afford it.

Moreover, each time you transfer the money, the processing fees fluctuate automatically. Using Fintech services, businesses could save from charging these unnecessary fees. There are many financial tools available. One no longer has to worry about any cancellation fees or hidden charges, they can send or receive money across the world instantly in different currencies through mobile devices.

Lastly, can anyone think of integrating physical and digital payments? Well, now this is a reality where multiple bank accounts can be managed using a single interface. And you know what is the best part? This fintech software is beneficial for consumers as well.

2.2 Compliance + Security = Fintech

Many people might not agree that Fintech is highly secure but it is much safer and more secure than traditional banks.

According to several sources, traditional financial services companies have significantly fallen behind in security. Unfortunately, that’s true! Now since Fintech’s fundamentals include the effective use of technology, compliance and security are less likely to be issues.

2.3 Upgraded Payment Systems

After addressing security, the next step is to upgrade payment systems. To stand out in the market, the use of fintech software becomes a necessity. As a result, your business can become more effective, which is possible only by using upgraded payment systems. Also, this leads to enhanced business-client relations and increased return on investment (ROI).

2.4 Speed and Convenience is Best for Companies as well as Customers

As mentioned earlier, providing instant results and taking care of customers has become a priority for every industry, and FinTech is no exception. Now it is possible to offer digital payments or lend money without delay.

For example, let us assume that you want short-term loans or some money just for a day. You will come across a wide range of potential businesses that you would like to offer these services. These businesses effectively utilize technology and maintain the economy.

2.5 Transparency

With the rise of Fintech in the traditional banking and financial services sector, the term transparency is no longer just mentioned. It is now being genuinely implemented by the vendors. Several new benchmarks have been set by providers across the globe. Other than just sending or receiving money everyone is kept in a tight loop that promotes full transparency. This creates a win-win situation for both the banking industry and their valued customers.

Of course, you do get all the other benefits such as 24/7 dedicated customer support, real-time updates, and tight security measures.

3. Different Use Cases of Fintech

Since we have covered the basics of fintech now it’s time to be precise. For a better understanding let us go through these common use cases of fintech.

3.1 Online and Mobile Payment Systems

There is no denying the fact that Fintech companies have made some significant changes in the way we buy and sell products – both as businesses as well as individuals. Conducting transactions via smart devices and computing systems was a pure myth at some point in time and today it has become a reality.

Today if you ask anyone whether he is a 35-year-old job worker a college-going kid or a 60-year-old retired businessman, how would they like to make payments? They would say using mobile payment apps be it Google Pay or WhatsApp payment or anything else. In India, IT minister Ashwini Vaishnaw uses his Twitter handle to broadcast the rise of UPI payment, which is one of the online payment methods.

The cash-based society seems to be doomed, which is not a problem at all. These online transactions have led to several benefits such as corruption has decreased, a few underdeveloped banking sectors have experienced growth, and managing finances is no longer as complex as it used to be.

Here is what Twitter user says about mobile payment systems.

🇮🇳 records 6 billion UPI transactions in July. pic.twitter.com/QL8O95jEWf

— Ashwini Vaishnaw (@AshwiniVaishnaw) August 2, 2022

3.2 Trading

Of course who doesn’t believe in trading and investment? After all, this is one of the surest and safest ways to multiply your money in the least amount of time. With the rise in fintech, the use of emerging technologies such as Artificial Intelligence, Machine Learning, Natural Language Processing, DLT(Distributed Ledger Technology), and big data, has made gaining relevant insights easier than ever.

Also, you will come across a wide range of stock trading apps where not just transactions can be carried out but also assets can be managed easily.

3.3 Crowdfunding Platforms

First, what are these crowdfunding platforms? These platforms enable internet or app users to send or receive money from different digital platforms at the same time. Now, you are no longer required to beg in front of conventional banks for loans, all you have to do is find investors who are ready to support you, and your work is done.

GoFundMe and Kickstarter are certain examples to take into consideration here. Whether you want to pay hospital bills travel or conduct fundraisers or any such charitable events, crowdfunding platforms can be extremely helpful where Fintech can be useful.

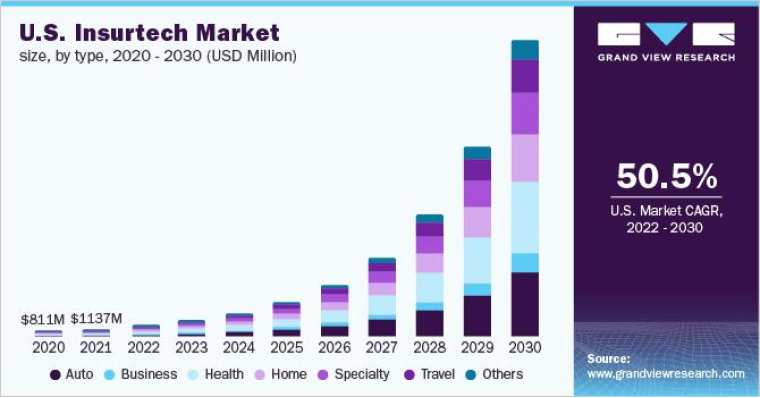

3.4 Insurtech

Lastly, we have Insurtech. Fintech is not just limited to the legacy financial institutions or the banking industry, it has created a huge impact on the insurance industry as well. Insurtech is repeatedly being recognized again and again. And why not since this one has left no stone unturned in maximizing savings?

More and more fintech companies are found collaborating with insurance companies to streamline procedures and enable them to focus on other interesting aspects.

4. Which Technologies are Shaping Fintech’s Future?

Here are some technologies that have been used for Fintech companies:

4.1 Artificial Intelligence

Artificial intelligence (AI) has transformed the way fintech organizations grow and the services they provide to customers. AI and Machine learning can identify fraud, enhance client value, and reduce operating expenses. As these technologies continue to decrease in cost and increase accessibility, they are expected to play a larger and larger role in the ongoing growth of fintech innovations, particularly as more traditional banks transition to digital.

4.2 Blockchain

By increasing the reliability, accessibility, and efficiency of monetary transactions, blockchain is a powerful technology that is reshaping the fintech sector. It provides a way for immutable ledger systems that are decentralized, eliminating the need for middlemen and their associated costs.

The financial technology industry has found several uses for blockchain technology, such as digital money, smart contracts, identity verification, and supply chain management. It is perfect for safe and efficient financial transactions since its decentralized structure ensures trust and immutability. Blockchain technology allows fintech organizations to improve data integrity, simplify operations, and provide clients with new financial options.

4.3 Cloud Computing

With the use of cloud computing’s automated and integrated security mechanisms, security is significantly improved. Don’t forget that there’s always a risk associated when handling sensitive data, especially considering the regulations specific to your field.

Studies suggest that cloud data warehouses are more reliable than traditional IT infrastructures. Well, the cloud can prevent fraud and data leaks more effectively, thanks to its features like zero-trust verification and data encryption.

4.4 The Internet of Things (IoT)

In the finance industry, IoT applications refer to wireless communication networks, operations support, and smart sensor systems. The increasing number of connected devices guarantees that Internet of Things (IoT) technologies will undergo rapid evolution in the coming years.

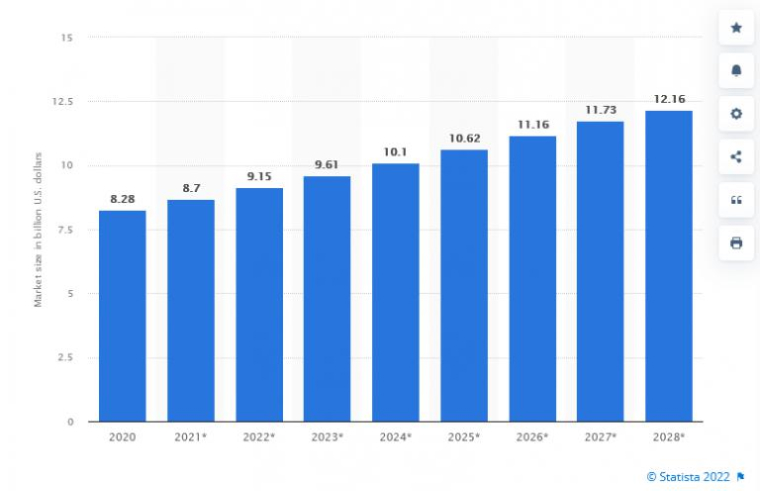

5. What is the Future of Fintech?

FinTech has grown substantially in the last decade. The way we shop and manage our everyday financial activities has been transformed by FinTech, which is now adopted by both new and established businesses.

The goal of many fintech startups is to transform the financial services industry by making them more responsive and efficient. The financial industry has been significantly shaped by fintech in the short time it has been available. Private venture capital firms have been investing in fintech startups since the industry’s beginnings. Traditional financial institutions and businesses are now also investing in the same fintech companies that initially challenged their business models.

Technology is becoming more important for businesses and banking consumers as they manage their financial lives. The bigger picture and long-term trends for fintech’s future are mostly unaffected by the present economic instability. Legacy banks and fintechs are expected to merge, form partnerships, and maintain ongoing relationships. Additionally, customers should expect to see a steady rise in the number of businesses advertising bright, newsworthy services like peer-to-peer transactions, blockchain technology, cryptocurrencies, and artificial intelligence.

6. Conclusion

Brace yourself up as the fintech companies are going to get bigger and better. Let’s keep our fingers crossed and keep watching the space to know more about what exciting lies ahead in the Fintech space.

Amazing post! The details that you have mentioned in this article were very interesting and helpful. I really liked that you covered how fintech changed the whole industry, how mobile devices help lead the businesses, and how fintech is cost-effective than traditional services. Keep writing more!

Really very happy to say, this post is very interesting to read. It explains everything in detail, and in a very effective manner especially the Importance of fintech part that you mentioned in this article. I think the adoption of the new technology in the fintech sector will change the entire scenario of the financial industry.

Thank you for sharing this informative article. I truly think that fintech is going to stay here for longer period of time because every financial service provider is now adopting Fintech and it will become even more popular. More and more utilization of Fintech in applications will make easier for users to do their daily transactions. I think such innovations are boon for everyone.

Fintech is a combination of finance and technology that has reshaped traditional financial services. Fintech has enabled people to access a variety of financial services on their mobile devices, improving the convenience, security, and affordability of financial transactions. Thank you for sharing this useful insights on fintech.

Fantastic article on fintech! I'm interested to see how the fintech industry will continue to transform the conventional financial services business and make financial services more accessible to everyone.

Thank you for sharing this informative article on fintech. With the revolution of technology in the financial sector, we can transfer money at our fingertips, pay bills, easily take out a loan from a bank, and much more. It is continuously expanding and will become an automated way to manage financial services.