Financial custom software development is so much in talks these days. This post...

We offer unique, innovative, and cutting-edge custom financial software development services to all financial institutions. This includes small and large-sized enterprises, fintech organizations, and many more. Regulatory requirements, financial data security, and connectivity are most important in this domain and we ensure our financial software development solutions cover all of these aspects.

Financial Software Development Services

Our financial software solutions automate business processes for fintech companies, providing them with secure, regulatory-compliant, and scalable platforms to run their business efficiently. As a financial software development company, we have specialized in creating various solutions such as loan processing solutions, forex applications, pension systems, ERPs, and many more for over two decades.

Consumer Finance

We develop fintech software that helps credit unions process loans and manage customers efficiently.

Forex Solutions

We develop custom corporate and personal forex solutions to meet currency exchange requirements.

Fraud Prevention Solution

We develop a fraud prevention solution that helps to detect and prevent fraudulent banking practices.

Consumer Finance

A paperless lending system developed to integrate with different loan departments via custom workflows. This integration aims to facilitate seamless communication, reduce discrepancies, and improve customer experience. Furthermore, the system offers centralized document management and a simplified approval process, improving turnaround time. Some other features and functionalities of consumer finance solutions are mentioned below.

- Online loan request & Pricing

- Document Verification

- Digital Signature

- Loan Level Accounting

- Online Loan Application

- Automated Assessment

- PreClosing

- Secondary Marketing

- Loan Details

- Conditions

- Closing

- Loan Extension

- Customer CRM

- Bank Account Validation

- Underwriting

- Notifications

- Pipeline Details

- Credit Check

- Payment to Bank Account

- Strong User Security

- Document Management

- Approval Process

- Automated EMI Deduction

- Customer Referral

Forex Solutions

We aim to offer web-based fintech solutions that can seamlessly cater to FOREX needs, quicker money transfer, and regulatory requirements, and address the business complexities of the industry. Our financial software development services seamlessly integrate multiple third-party systems in a heterogeneous environment, improving business efficiency.

Online Forex Platform

- Multi-Terminal Live FX

- Spot and Forward Trade

- Direct Debit via bank Account, Credit Card

- Trader accounts with Advance Features

- Market Orders and Limits

- Trade Limits And History

- Traders Quote Management

- Mass payment Solutions

- Beneficiary Management

- Security and Multi-Step Authentication

Currency Exchange POS

- FX Data Management

- Central Database and Rates Management

- Cash Register Transactions

- Currency Exposure Management

- Currency Exchange via Cash, Credit Card, and Traveller Check

- Wholesaler Features

- Liquidity & Risk Management

- Secured Synchronization of Cash Registers

- Regulatory Compliance

- Security and Privacy of Personal Data

Custom ERP Solutions

Customized accounting and ERP Solutions, developed by our experts, enable businesses to onboard an unlimited number of users and become more efficient and profitable. It helps the client to increase turnover, improve margins, enhance security, and ensure safe processing. Some other features and functionalities of Custom ERP Solutions are mentioned below.

- Accounting Management

- Data Security

- Powerful Reporting System

- Multiple Currency Compatibility

- Intuitive Navigation Screens

- On-Premise & Cloud Hosting

- Tax calculation

- Customer Relationship Management (CRM)

- Financial Activities Management

- Integration with Microsoft Power BI

Fraud Prevention Solution

Fraud prevention solution equipped with the latest authentication and security protocols, developed by us to allow cardholders to authenticate themselves without any issues. It also ensures a great user experience by smoothing the entire transaction process with multiple features like:

- Multichannel authentication for all devices

- User friendly web based admin

- Fraud Detection

- Secure Message Flow

- Secure customer authentication

- Payment Gateway

- Customer Management

- End to End Testing

- HSM Support

- Easy check out process

Microfinance Solution

Our Saas-based Microfinance solution makes the process for both personal and business loans very smooth. Users can easily invest his/her savings via fixed deposit and other various investment options through this portal. This solution creates a micro banking ecosystem that seamlessly integrates various processes like:

- Bank Statement Optical Character Recognition (OCR)

- Customer 2 Factor Authentication

- Fixed Deposit and Smart Goal Accounts

- Mail Notifications

- Customer Relationship Management

- Loan Prediction Engine

- Loan Orchestration

- Mail Reader Automation

- Generate Loan Offers

- Payment Gateway Integration

- Bank Account Verification

- Saas Banking Platform Integration

Fintech Software Development Case Studies

Discovering and analyzing the details of each software development project to achieve measurable outcomes is what we have done as a leading financial software development company.

Benefits of Using Custom Financial Solutions

Secure

Custom solutions enable the effective implementation of robust security measures tailored to the system’s specific requirements, minimizing vulnerabilities and ensuring data protection against cyber threats. It also uses the latest technologies to proactively identify and address potential threats.

Scalable

Tailored finance software is easy to scale as your business grows. Custom software architecture can seamlessly integrate with third-party services and support new functionalities. This enables you to quickly respond to market trends and scale your finance operations at a lower cost.

Regulatory Compliance

Custom-built finance solutions comply with industry regulations, including PCI DSS and GDPR. Compliance management and reporting processes are automated to ensure seamless finance operations within regulatory boundaries.

Increased Efficiency

Reduce the burden of manual tasks by automating repetitive and time-consuming finance processes such as compliance reporting and transaction processing. This helps reduce errors, streamlines business workflows, and increases overall operational efficiency.

Cost-effective In The Long Run

Custom finance solutions are designed specifically to meet your unique business requirements. They exclude generic features that may be unnecessary, helping to reduce the costs. Moreover, there are no recurring licensing fees.

Financial Software Development Process

Planning

After gathering your requirements, our analysts conduct research to check the feasibility of the idea and identify potential risks. They then prepare a comprehensive development plan detailing the scope of deliverables, deadlines, required resources, estimated costs, team size, and other key factors.

Design

Considering the requirements, we design an appropriate architecture for the finance solution. Our UI/UX designers create functional and elegant interfaces with easy navigation systems. This stage also involves prototyping to validate the concept and gather valuable feedback.

Develop and Test

In this stage, our skilled developers begin coding to build the app architecture, components, modules, and features that help meet the user requirements. After each iteration, the code is thoroughly tested for bugs, and QA experts verify that it meets the required quality standards.

Maintenance

Once the testing and QA teams give the green light, we help you in safely deploying the software into the production environment. TatvaSoft also offers post-deployment support, including scheduled maintenance, regular software updates, bug fixes, and ongoing system monitoring.

Why TatvaSoft for Financial Software Development?

-

End-to-end Software Development

TatvaSoft offers full-cycle financial software development services. We assign a dedicated team of engineers to your project, managing every phase from planning to post-deployment support. This approach ensures the delivery of efficient, high-quality financial solutions.

-

Profound Industry-Specific Technical Expertise

TatvaSoft's software developers bring over two decades of experience addressing the various needs of the financial services industry. They combine business insight with technical expertise to understand your requirements, drive innovation, and ensure regulatory compliance.

-

Robust Security Measures

Our development team implements robust security measures, including multi-factor authentication, data encryption, and strict access controls. Regular security audits and quality assurance processes ensure the delivery of tamper-proof financial solutions and protect sensitive customer data.

-

Transparency and Agile Approach

TatvaSoft emphasizes transparency by involving clients in every decision related to finance software development. Our team follows an agile approach focused on customer-centric product development, ensuring timely delivery, quick optimizations, and continuous visibility throughout the process.

Financial Software Development FAQs

-

How is the Financial App Development Process initiated?

For any type of financial application development, we proceed with a simple and proactive approach. The development of financial apps is divided into five fundamental steps:

- Conducting research of the requirements

- Developing a prototype

- Product design

- Product Development

- Product Testing

- Product Deployment

- Maintenance and Support

-

What type of services do you offer as a Financial Software Development Company?

As an experienced Fintech Software Development Company, we are developing software, mobile, and web applications that are more secure & faster and provide consulting services like:

- Custom Fintech software and application development

- CRM and Business Intelligence solutions

- Intelligent Accounting

- API Programming and software Integration

- Software Upgrade

-

What are the types of Fintech Software you develop?

Fintech as a service offering is expanding, and there are numerous types of software applications you can build for your finance business. Following are the types of Fintech software we cater to clients

- Digital Lending Apps

- Payment Processing Software

- Expense Management Software

- Crowdfunding Platforms

- Budgeting Apps

- Accounting Management Systems

- Investment Management Solutions

- Portfolio Management Solutions

- Online Forex Solutions

- Insurance Software Solutions

- Microfinance Solutions

- Fraud Prevention Solutions

-

How much time does it take for you to develop a Fintech Software?

The time required to build a software, web application, or mobile app is dependent on the requirements and their complexity. As a fintech software development company, we start by thoroughly understanding our customer's requirements before developing a complete roadmap based on their business goals and objectives.

-

How much does development cost for a Fintech app?

Financial software development is a complicated process, and it's difficult to estimate the entire cost without understanding the specifics of the project. For further information feel free to get in touch with us at info@tatvasoft.com

-

Do you sign an NDA?

Yes, we do sign a Non-Disclosure Agreement(NDA) before initializing the project services to eliminate the possibility of any unethical data breaches and safeguard IPs and vital data of companies.

TatvaSoft Blog

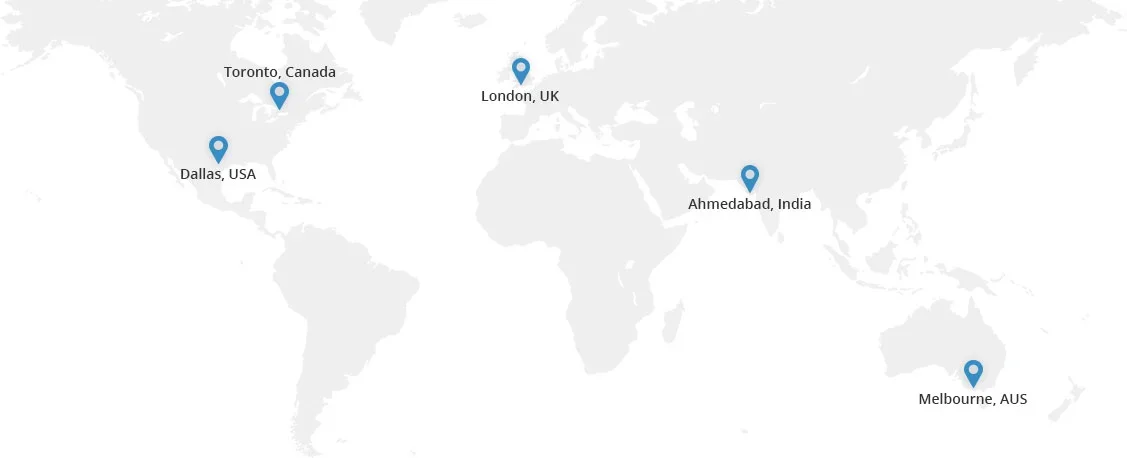

Global Presence

As one of the leading financial software development companies, TatvaSoft has established a global presence with offices in seven countries, including the USA, UK, Canada, Australia, Japan, Saudi Arabia, and India with a skilled team specializing in different technologies.

We are tapping into the power of the digital world, creating high-impact finance software solutions to boost business efficiency. TatvaSoft as a finance software development company is committed to providing end-to-end customized solutions to our global customers and tackling the technology problems faced by businesses.