As time progresses, every industry is moving towards digitalization and the banking sector is one such major industry that strives to adopt modern approaches and integrate digital technologies to provide digitized processes for the customers. Though this is a complex approach, the use of modern technologies can make it easy for any bank to transfer its legacy system to digital channels. And for this, proper digital strategies must be applied which can be carried out by financial software development companies. The experts from fintech app development companies can assist financial institutions in achieving a complete digital transformation in banking.

To learn about it, let’s explore the technologies that can be used, and examine the pros & cons of digital transformation in the banking sector.

1. What is Digital Transformation in Banking?

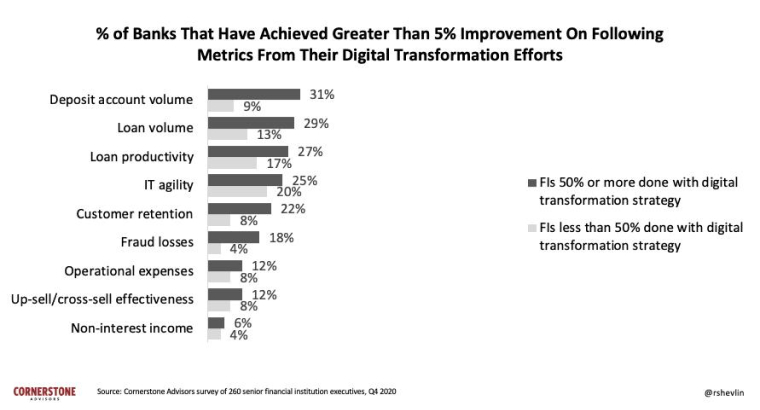

Digital transformation is a process in which modern technology integrates with various areas of the bank, helps in delivering good value to customers, and optimizes financial operations. Over time, technology has entered the banking sector in various ways. Digital transformation has brought about significant innovation in the financial world, and leading banks and financial institutes are adopting it. It also enables the banks to offer unique features to the users through their digital channels which can lead to customer acquisition.

This means that digital banking transformation or the adoption of new technologies and approaches has changed the banking sector completely. Now banks can offer mobile services to their clients. Bank can understand customers’ behavior and offer strategies accordingly. For this purpose, technologies like AI, Cloud Computing, Blockchain, and more can be used.

1.1 Advantages of Digital Transformation in Banking

Some of the major benefits of digital transformation strategy in the banking industry are-

1. Convenience

With the help of technology, everyone can access their bank accounts from their devices. The only thing required to do so is a proper Internet connection.

These banking apps have increased customer satisfaction by helping users to easily track their banking details like account balances, transactions, and more.

2. Improved Security

Technologies like blockchain, AI, and IoT enable banks to safeguard their important information by offering data encryption software. That can save banks from both external threats and unauthorized access. This eventually helps in increasing transaction safety.

3. 24/7 Service

Online banking services operate 24/7, allowing users to perform any type of banking services at any time through their mobile devices. They don’t need to stand in lines to get their payments done or deposit money. This is the biggest advantage that comes with digital banking.

4. Time-Saving

Online banking is a very time-saving concept. Users can access their accounts anytime from anywhere. They don’t need to waste time visiting the banks in person. This is highly convenient for the users.

5. Automated Transfers

Through digital solutions, unlimited automated transfers are possible. This means that an n-number of payroll deposits can be accepted with no additional fees for the services.

6. Customization

One of the most beneficial things that online banking can offer is customization. And this can eventually improve customer experience. For this, banks can use software with the right data analytics and data mining techniques to automatically offer personalized services to customers.

1.2 Disadvantages of Digital Transformation in Banking

Some of the disadvantages of digital transformation in banking are –

1. Security Issues

Security issues with online banking systems can lead to data theft or any other type of fraud. Financial institutions can use sophisticated software to protect customer data from phishing, scammers, and hacker attacks.

2. Requirements for Hardware and Personnel

Digital technologies require professionals to implement them in the firm effectively. Banks need to hire professionals who can handle the software and hardware of the firm and keep them updated after transferring the data from legacy systems to modern tools.

3. High Costs

The use of modern technologies can be very costly as it requires high maintenance, the best specialists, and more.

1.3 Key Aspects of Digital Transformation in Banking

Digital transformation trends are driven by the fast upgrading of digital tools and technologies, better network connectivity, and a rise of smart devices, regardless of the various end-user bases. Key Aspects that are crucial to the digital revolution in the banking industry include:

- Automation in Banking: Machine learning, artificial intelligence, and robo-advisors are just a few examples of automation technologies that can simplify processes, save costs, and increase productivity. Loan processing, currency conversion, and internal auditing, along with other similar processes, can be automated.

- Personalized Customer Experience: Banks must use digital technology to improve customer experience, transactional convenience, seamless inquiry, security, and the simplicity of conducting business as more and more customers depend on digital channels for financial services and banking.

- Security Improvements: Using cutting-edge cybersecurity measures to secure client information, avoid fraud, and guarantee compliance with applicable rules and laws.

- Digital Infrastructure: The rise of digital-only banks is a direct result of the trend toward digital banking. These businesses typically offer better interest rates and lower costs compared to traditional banks. To keep up with the competition and satisfy their clients’ ever-changing demands, traditional banks are also digitizing their systems and procedures as part of their new digital infrastructure.

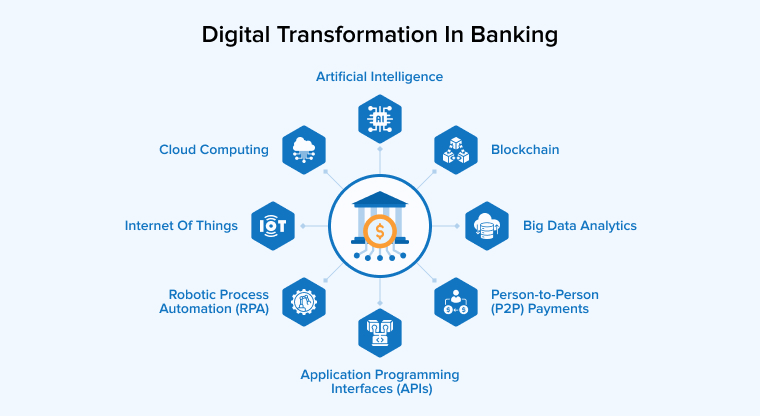

2. Technologies Driving Digital Transformation in Banking

Here are the technologies that are impacting digital banking transformation in the banking industry.

2.1 Artificial Intelligence

Artificial Intelligence (AI) is a technology that is changing the entire banking sector. AI offers various benefits such as low cost and more revenue through multiple channels. With the help of AI technology, modern banks can improve their processes, speed, efficiency, and accuracy. As per a survey by Business Insider Intelligence, the average cost saved by banks because of AI implementation is about to reach 447 billion dollars by the year 2023.

Artificial Intelligence-powered tools can be used by banks to handle extensive data histories and support decision-making, enhancing the client’s experience. The benefits of AI in banks are widespread, such as improving customer experience, digital engagement with clients, reaching back-office operations, enhancing product delivery, ensuring compliance, boosting marketing efforts, and strengthening risk management.

2.2 Blockchain

Blockchain is one of the most popular technologies in the market. It is a distributed ledger that operates on a decentralized database and allows developers to offer services that can protect the customer’s financial data from real-time transactions.

Blockchain is decentralized and is an immutable chain that saves all the essential data of the blocks. It doesn’t allow any form of data tampering and ensures high security and integrity. This is why it is the best technology for any bank or financial institution undergoing a digital transformation. Besides this, blockchain can resolve any issues like cyber-attacks and fraud. Blockchain promotes transparency for every bank or credit union.

Blockchain is a distributed ledger technology that enables developers to create systems that can streamline all banking operations and automate the process with the help of digital platforms. Banks use blockchain technology to carry out various operations like fraud reduction, inter-bank transfers, KYC processes, cross-border payments, lending, and more. This proves that the use of blockchain technology can help banks in enhancing their remittance, contactless payments, and traceability goals.

Here is what YvesMulkers tweeted about blockchain in banking:

#Blockchain technology disrupting #digital banking;One of the most-discussed topics over the past few years is the transformation and digitization of the financial sector. As it is evident, a lot #7wData #DataStrategy

— Yves Mulkers (@YvesMulkers) May 5, 2024

2.3 Robotic Process Automation (RPA)

The banking industry prefers to use intelligent automation as it helps drive efficiency, improves customer satisfaction, and eliminates the chances of reputation. The technology that can offer all these things is known as robotic process automation (RPA). With the help of robotic process automation, banks can start using bots for customer services. Besides, the banks don’t even have to worry about the low-priority questions that can be asked by customers. Similarly, it helps save a lot of time that goes behind dealing with customers’ high-priority concerns.

Robotic process automation is a technology that can easily help banks improve productivity, data analysis, reducing operational costs and errors. It also reads customer behavior to enable all the users to make a quick decision for their credit card application with RPA without any human intervention in the process.

2.4 Application Programming Interfaces (APIs)

Application Programming Interfaces (APIs) are very important when it comes to the banking sector as they enable business organizations to connect with new partners and customers while creating new services and products. This is why businesses use APIs and expose them which eventually makes the developers create applications and integrations that work with their systems. This can eventually help in reaching new markets and driving innovations. Besides this, APIs enable businesses to customize their business operations by automating the processes.

2.5 Internet of Things

The Internet of Things is a popular technology that connects devices on any network to provide data-driven insights for the future. It has gained popularity in banking services because it enables retail banks to have consumer-facing capabilities and improve internal infrastructure. IoT is a technology that covers various banking solutions and some of them are-

- Smart Collaterals: IoT technology helps banks handle customers’ mortgaged assets like machinery, cars and helps them to monitor everything. Besides this, it also enables the banks to issue customer loans immediately and then the banking staff can monitor the collateral status using applications or software in real-time without taking physical custody. Banks can handle the loans remotely and smartly manage the collateral.

- Wearable Payments: IoT has popularized wearables in the market. Wearables include smart rings, watches, and more. These devices help in enhance the retail banking experience. For instance, if the user has a smartwatch, it can be added to the style statement, and later it can be helpful to transfer money or make any sort of payment.

Basically, with the help of IoT, wearable devices can offer an entirely new online banking experience to customers and banks. Customers can communicate with the banks directly through smartwatches. The concept of smart glasses has also emerged which is being adopted by some financial institutions. Smart glasses can help banks to process customer information. This proves that wearables with IoT support have impacted the banking industry, providing the potential to organize everything digitally without any hassle.

2.6 Cloud Computing

Cloud Computing is a popular technology driving digital transformation in the banking sector. The implementation of cloud computing has helped banks in enhancing their performances and scale up services. It introduced a concept known as pay-as-you-go. This facility makes it easier for businesses or individual clients to pay for the cloud services that they have used. Financial institutions can benefit from using cloud computing which helps them to promote wallet payments, online payments, and digital money transfers. Basically, with the help of cloud-based services, financial service providers can easily decrease data acquisition and storage costs and this is possible through saving on operating expenditure (OPEX) and capital expenditure (CAPEX).

Cloud computing is a technology that has helped banks to carry out their business operations with ease.

2.7 Big Data Analytics

Data is the most important thing in any business organization. Companies gather customer data and evaluate it with the help of a technological concept called Big Data Analytics. The most use of Big Data is done by large financial institutions because they have access to a large amount of data that might not be currently used but is important. With each passing day, the amount of data in the banking landscape increases. In such situations, advanced analytics helps banks create new business models to identify correlations from the data, analyze the time series, and recognize the trends from the client’s contact details.

This benefits fintech companies as they get access to clients’ data which they optimize to offer the best customer experience. Besides, the knowledge of customers’ likes or dislikes and their feedback can help banks to come up with suitable services that can offer customer satisfaction.

2.8 Person-to-Person (P2P) Payments

P2P payments, which stand for “peer-to-peer,” allow you to transfer funds directly to another user. Quick money transfers are possible with peer-to-peer (P2P) payments; all that’s needed to transfer money is the bank account or phone number of the receiver.

3. Examples of Digital Transformation in Banking

You may learn a lot about how to organize and execute your changes by studying the digital transformation of other banks. Here are three examples where the banking business underwent a successful digital transformation.

3.1 Santander

Here is how Santander Technology UK’s Director of Operations, Joaquim Cols, approaches digital banking:

He mentioned, “We wanted to create an ecosystem that would enable this organizational construct to have more agility as an enterprise, and that would allow us to connect strategy to delivery, add transparency, and simplify processes day-to-day… at the very base is optimizing IT tooling.”

A responsive and adaptable strategy was necessary for Santander in light of the dynamic nature of the UK banking industry. The lack of integration between Santander’s business and IT processes caused them to make decisions slowly and to oversee resources poorly, both of which slowed down the process of implementing change. Their software and operating model are required to adapt to their changing needs.

One of the main reasons Santander was successful was because of Planview’s Project Portfolio Management solution. With Planview, Santander could unify their formerly separate businesses into a streamlined operation. Accelerating this integration and enabling flexibility to ever-changing conditions and governance were the goals of combining agile procedures with traditional project portfolio management.

Santander invested 6.5 million hours annually overseeing 500 business projects, 2,500 tasks, and 4,000 users, according to Planview. They saw an 80% improvement in budget restructuring and a 25% improvement in decision speed after implementing ProofHub’s resourcefulness monitoring tools.

3.2 Natwest

Here is Stephen Marjot’s strategy for digital transformation at NatWest (formerly RBS):

He mentioned, “We had to move from a traditional operating model based on traditional methodologies to thinking more about incremental, iterative value delivery where we could pivot quickly to meet the changing needs of customers.”

The general population formerly known NatWest as Royal Bank of Scotland (RBS) before to July 2020. With a history spanning centuries, this financial institution is well-versed in adapting to new circumstances. They were aware that any change would have to be gradual due to their global presence which includes more than 700 branches and 70,000 workers.

Rapid change was difficult for RBS before its digital transformation initiatives due to the high number of organizational layers and the reliance on manual processes. Management frequently disregards innovations that boost efficiency and production when there is a lack of openness.

By fostering visibility throughout every group, their transformation facilitated the accurate identification and definition of dependencies, which in turn assisted to standardize and optimize tool sets and procedures. They also instituted a company-wide Lean-Agile mindset and set of procedures.

3.3 Commonwealth Bank (CBA)

The executive general manager of CBA Bank is Christian Eggers. Here is how he explains what matters to CBA:

He mentioned, “CBA [will] deliver and manage our significant change agenda through greater transparency of project data.”

Commonwealth Bank (CBA) also struggled with digital transformation, although representing one of Australia’s biggest banks. Christian Eggers, CBA’s executive general manager, recently discussed the company’s former tools and the issues they encountered in an interview. The lack of shared project data across teams, the proliferation of competing “sources of truth” for various procedures, and the increasing complexity of spending justifications were all factors.

Companies that spend a lot of money on technology every year might benefit greatly from modern portfolio management tools. CBA intends to use this software to standardize over a hundred financial operations for a workforce of more than 10,000 people.

To replicate those degrees of success, bank executives should study the history of bank conversions. But as they plot out their transition to digital banking, the executives should consider the most important trends in the market.

4. Conclusion

As seen in this blog, accelerating digital transformation in banking is a very important concept as it enables the banking sector to offer the best services to its clients, improve the level of customer satisfaction, and stand out in the competitive market. For this, various modern technologies like artificial intelligence and machine learning, data analytics, blockchain, etc, can be used which might be a bit expensive in some measures.

FAQs

What are the Four Pillars of Digital Transformation in Banking?

Four main pillars of digital transformation in banking are:

- Redesigning the business model.

- Reinventing consumer experience.

- Leveraging data analytics.

- Creating a digital-driven organization.

How Does Digital Transformation Affect the Traditional Banking Sector?

Digital transformation impacts the traditional banking sectors in a few ways which include improved customer experience, convenience & accessibility, and increased efficiency.

How Technology is Changing Banking Sector?

The use of the latest technology impacts the banking sector in many different ways such as –

- Faster banking process with reliable maintenance of the documentation and records.

- Innovation in cheque processing approach with faster results.

- Improvement in the core banking system with all new access to centralized data.

Comments

Leave a message...