Before the epidemic, AI implementation in the banking industry was extremely sluggish. When the world came to a halt, financial businesses and their associates throughout the world were finally compelled to automate the remainder of their banking operations and make them truly consumer-centric. What does the world of 2022 hold? Here are some of the finest fintech trends to keep a watch on in 2022!

The global FinTech market size is projected to reach USD 16652680 million by 2028, from USD 6588780 million in 2021, at a CAGR of 13.9% during 2022-2028.

By the end of 2028, the global FinTech market size is expected to reach USD 16652680 million, from USD 6588780 million in 2021, at a CAGR of 13.9% during 2022-2028.

1. Latest Fintech Trends to Watch

This or that, digital banking and fintech companies are anticipated worldwide to only keep going up. As a result, banks and financial institutions today are found making the most of financial technology. Further, let us discuss the current hot fintech trends in the following post.

1.1 Artificial Intelligence & Machine Learning

AI in the Fintech market is expected to register a CAGR of 25.3% during the forecast period (2022 – 2027). Artificial Intelligence popularly known as AI is quite on a rage these days. Do you remember chatbots?

The best client service software is used by businesses to connect with their customers without them actually having to chat. Artificial intelligence, machine learning, and deep learning are such trends that enable fintech firms to segment consumers by what they need. For example, Imagine when you for the first time took any financial product into account. There was no credit history, no credit score, or any signs indicating that you won’t get bankrupt so easily.

On that note, the importance of perfect credit histories and scores was observed when fintech came into existence. Though it might seem pretty a small aspect to neglect but quite an effective point. You see the actual benefit of such fintech patterns comes from understanding the genuine reliability of the rest of the market and how one can draw in numerous great clients at rates that they can reimburse with unsurprising and sensible default rates.

1.2 Autonomous Finance

Here Gartner shared some tips in their twitter to revolutionize corporate finance.

Believe it or not, there was a time when financial service providers and customers suffered a lot as in-person transactions were out of the question those days. Thus, both the banking industry and the financial sector needed to come up with the latest development in fintech.

Money transactions are no longer the same as they were years back – all thanks to the ever-changing digital revolution. Technically, the autonomous finance term revolves around self-driving funds. If you are seeking around for apps that guide customers in making investments and managing unavoidable risks, Autonomous finance apps must be considered.

Moreover, it’s not just limited to businesses, even several banks and the financial sector can make the most of this trend. Many financial software development companies offer cutting-edge platforms and apps to offer autonomous finance, digital lending, and other financial services. The loan approval procedures become faster at considerable interest rates.

Ready to revolutionize corporate finance? Begin with the 3 technologies driving autonomous #finance:

— Gartner (@Gartner_inc) October 4, 2022

1⃣ #AI

2⃣ #Blockchain

3⃣ Hyperautomation

Learn more about the future of finance: https://t.co/bzLxMqou46 #GartnerFinance pic.twitter.com/7VzqQUByVs

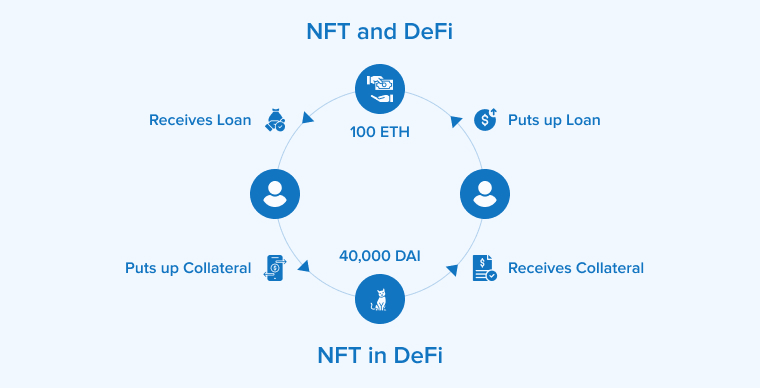

1.3 Blockchain Fintech

According to Markets and Markets, the global blockchain fintech market size is expected to be USD 6,228.2 million by 2023. Distributed ledger technology is rapidly serving as the modern world’s backbone. It is the innovation that powers Bitcoin and other cryptocurrencies, but it has a plethora of other uses.

The full potential of blockchain technology has not been even scratched. Over the next several years, this field may see some ground-breaking advancements.

Decentralized finance (DeFi) and non-fungible tokens (NFTs) are just two cases of how blockchain technology has the potential to transform the financial industry.

There are innumerable further applications for this technology, and it’s tough to forecast what innovations may emerge in these fields over the next few years.

Blockchain technology has enormous potential for expansion, but there are some obstacles to tackle before it gets more widely adopted.

Benefits of Blockchain:

- Fraud Prevention and risk management.

- Independent client verification.

- Trading Process Automation.

- Secure Payment Processing.

- Smart Payments.

1.4 Buy Now Pay Later

Buy Now Pay Later is an alternative form of short-term financing that allows you to pay for products later on in the future. Sometimes it works without interest which makes it an even more popular form of financing. With point-of-sale installment loans, customers can pay a certain amount on a purchase and then the rest amount later.

BNPL is a FinTech creation that allows customers to make a purchase and make payments later. It provides the best solutions and due to this reason it has received immense popularity among buyers. And working with the right business model will help any FinTech startup can thrive therein.

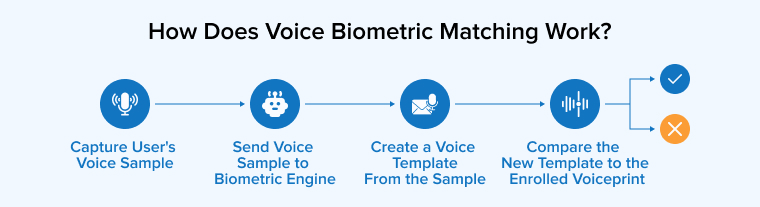

1.5 Biometric Security System

Mobile banking is now available literally at the tip of one’s fingers. Biometric technologies are based on measuring a person’s individual characteristics often known as biometrics. These features can be congenital (eye color, fingerprint pattern) or acquired and changed over the course of life (voice, handwriting).

Biometric technologies were originally used at military facilities. Then, they began in airports, bus stands, metro stations, basically all the places which include mass gathering. Some of the popular trends of biometric technologies include:

- Fingerprints

- Face Image

- Iris Image

- Voice

- Vein Prints

- Hand geometry

- DNA

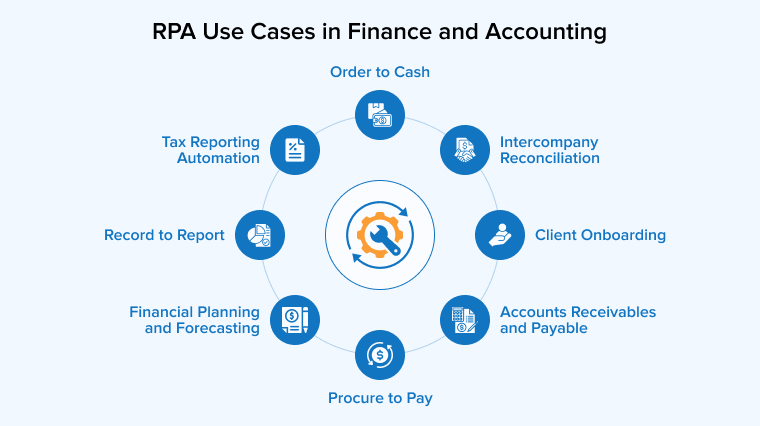

1.6 Robotic Process Automation (RPA)

According to Grand View Research, the RPA market will have a growth rate (CAGR) of 38.2% from 2022 to 2030. Another recommendable fintech software development trend is Robotic Process Automation (RPA). As the name implies the technology is meant to automate business procedures. In other words, a significant amount of manual errors can be reduced if one decides to incorporate AI, ML, RPA into their existing operations. Right from financial services and banking to healthcare, telecommunications, manufacturing, technology, retail, consumer goods, hospitality, RPA is everywhere!

Do you think all the action sequences are performed by the hero himself throughout the movie? Of course not! There are stunt men who mimic the hero available. Similarly, RPA bots tend to mimic interactions and tend to accomplish monotonous tasks at a fanatic pace. As a result, businesses can free up manual labor and switch them towards the core activities.

It’s benefits include:

- Enhanced efficiency and productivity.

- Accurate outcomes.

- Improved Security.

- Scalability.

- Improvised customer services.

1.7 Digital-only Banks

Here is the chart that shows global top digital banks where we can see that China’s WeBank, Ally Bank from the US, and ING from the Netherlands are on the top three list.

With the massive pandemic hit, there has been observed a severe change in the habits of a consumer. People no longer are willing to visit places whether it’s to shop or visit a restaurant or watch a movie, book tickets, make payments, all they want is to perform all these tasks simply by using their smart devices. And banking or managing their finances is no exception here. Digital banks have surpassed the way conventional and traditional banks are supposed to carry out tasks. Not to mention with the increase in digitalization, customers have become pretty much happy watching different banking organizations offering end-to-end services online. Some of its benefits include:

- Better convenience.

- Enhanced security.

- Full-control over finances.

- Spreading Financial Education.

- It offers numerous features such as tools to save, virtual assistants, etc.

1.8 Fintech-Bank Partnerships

Here’s the complete twitter thread about Fintech and Bank collaboration from Monica.

It is a safe bet to say that both the fintech and banking sectors are found to redefine the meaning of managing your finances. Though there was a time when the banking industry did not take fintech seriously and was pretty much suspicious about it but not anymore. With the rise of digitalization, banks are no longer enrolled in processing papers all day long.

Now fintech firms are always in need of relevant cash flow and by partnering with banks they no longer need to worry about that part. It becomes totally out of question. Apart from constant cash infusion, stability, and extreme market reach, better solutions can be gained with fintech-bank partnerships.

Is a Fintech and a Bank Partnership/Strategic alliance really ‘Made in Heaven’?

— Monica Jasuja (@jasuja) April 21, 2022

Is a Fintech a Bank’s biggest Nightmare or an ally?

What makes fintech-bank partnerships successful?

What business problems make a case for a bank and fintech to work together?

A Thread 🧵 👇

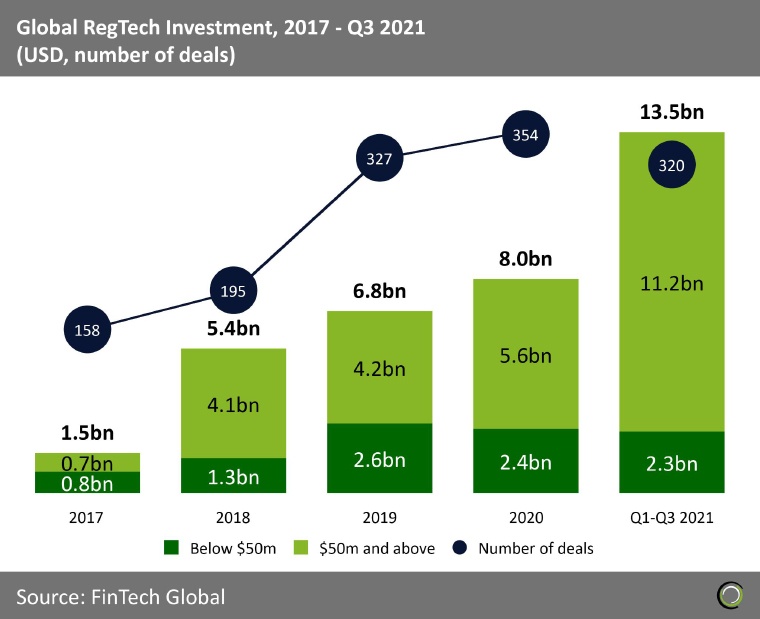

1.9 Regtech

RegTech refers to Regulatory technology which manages regulatory processes within the financial industry. Regulatory Monitoring, compliance, and reporting are the main functions of RegTech that help businesses comply with regulations efficiently and are less expensive.

Look at the below mentioned picture to uncover more about RegTech:

Businesses irrespective of their verticals are found looking for streamlining their ongoing procedures and banking is no exception. Here’s when Regtech comes to the rescue. Now, what exactly is this? Well, it is said that technology is being used to process tons and tons of data in a short period. Today, advances and investments in regulatory technology (regtech) are increasing day in and day out. Further, let us see how Regtech offers substantial benefits across the globe. And more importantly, why businesses have already considered it to be the next big thing!

- Saves ample of time, energy and money.

- Risk Management can be well-taken care of.

- Exploitation can be significantly reduced.

- Enhanced security.

- Streamlining work management.

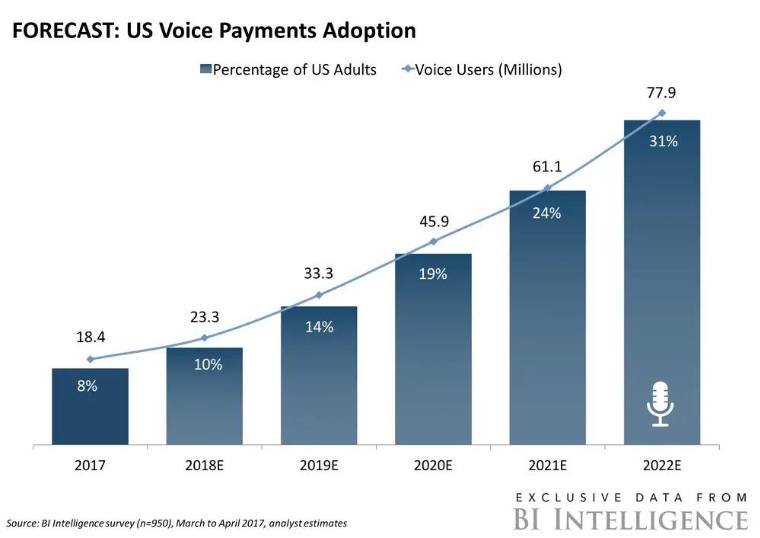

1.10 Voice-Enabled Payments

Do you know how many words can one speak within a minute? 150 to 160 max and how many words can one type in a minute? 40 – 50 max. So which one is more beneficial? Of course, speaking instead of typing. Keeping this fact in mind, our next fintech software development trend is voice-enabled payments. There is no denying the fact that voice assistants such as Google assistants, Siri, Alexa, and Cortana are growing at a fanatic pace.

- You can provide next-generation customer experience.

- Enhanced KYC.

- Say no to Fraud.

- Log in/out, checking the balance, making payments, purchases can be made via voice.

- Monitor finances.

1.11 Quantum Computing

Quantum computing was once considered a bizarre thought but fortunately not anymore. It has become a reality. Of course, this doesn’t mean there is no scope for uncertainty or fear but one has to step forward and take advantage of such disruptive trends, or else you may have a lot to lose.

What is quantum computing? pic.twitter.com/0vMLPJHJoA

— Vala Afshar (@ValaAfshar) October 31, 2022

Based on Quantum theory, Quantum computing is carried out in the banking sector to streamline several complex data operations. Not just this, more and more financial companies can research the present market and conduct predictive analysis regarding the same. You see, a normal computer can’t predict probabilities precisely. No wonder, tech giants such as Google and IBM are found pretty much invested in Quantum computing.

It’s benefits include:

- Improved cybersecurity.

- Fraud can be detected pretty much in advance.

- Predictive analysis.

- No downtime.

- Automation leads to well-informed, precise and quick decision making process.

2. Conclusion

So that’s all for now! These are the top ongoing trends in banks and financial industry institutions. So what are you waiting for? It’s time to give a seamless, cashless experience to your users.

Thank you for sharing this informative article on fintech trends. It's great to see how financial technology revolutionized the financial industry and created new advancements in businesses. These latest trends will help readers to stay up-to-date on the latest developments in the financial sector.

I enjoyed reading this article about the top fintech trends. I found the information about blockchain, AI, mobile banking, and biometric security helpful in understanding the growth of the financial industry.

Such a very interesting post on fintech trends! It seems that you have mentioned Google Trends, and the statistics of fintech trends look like they are going to become more powerful. Additionally, I believe that the growth of fintech-bank collaborations is really beneficial.