Nowadays, every business and financial organization wants to go digital and offer online payment systems to their clients to make their lives easy. Are you one such organization that is thinking of getting a fintech solution and finding a qualified financial software development company for that? Then you have come to the right place, here we will go through the details that will help you find the right fintech development company for your project.

1. What is Fintech?

Fintech means financial technology. It is the most innovative industry in the market. It is a technology that is used by companies that require the latest technological developments in order to compete with the traditional format of finances. Basically, fintech is used to improve and automate the use of financial services. At its core, financial technology is used to help business owners, companies, and consumers to manage their financial operations with the use of algorithms and specialized software.

In the 21st century, when fintech emerged, this term was initially meant for the back-end systems of financial institutions. And from that time, there has been a great shift in customer-oriented services. Fintech is now included in different industries like retail banking, education, investment management, and fundraising & nonprofits. It is also included in the development process and usage of cryptocurrencies like bitcoin.

Since its emergence, fintech has appeared in many different solutions like –

- P2P Lending

- Digital Banking

- Money Transfer

- B2B Fintech

- Investment Platforms

- PerTech

- InsureTech

You can read FinTech Vs Traditional Banking

2. How To Find A Fintech Software Development Company?

When it comes to finding a fintech software development company for your project, here are things that can be considered –

2.1 Perfect Skills

When it comes to finding a perfect fintech software development company for the business, one must look out for teams that use the modern architecture that guarantees easy integration and maintenance of fintech services. The reason behind it is that in fintech, only understanding the recent situation is not important but one also has to analyze it and make future predictions accordingly. So the firm that can offer all these things will be chosen.

2.2 Professional Developers

Fintech software development is a very complex process and this is why every financial company or business needs to hire a fintech software development company that offers industry-specific expertise. The company you choose must have highly skilled developers who have knowledge of various programming languages like Java, Python, C++, C#, PHP, Ruby, and Javascript. Besides this, a qualified fintech development company must have access to technologies like ML, AI, and Big Data.

2.3 Security

When it comes to fintech solutions, security is one of the biggest concerns as one minor error in the fintech software can affect the business drastically. And this is why business owners and developing companies must take security matters very seriously. And for that, the fintech software development company must be familiar with all the solutions to security problems available in the market. So, before finalizing a company, the financial institution must verify the knowledge of the firm’s developers regarding sensitive information security procedures.

Besides this, one must also verify that the IT company follows proper standards and rules while creating a fintech product.

2.4 Business Capability

When choosing a fintech software development firm, any organization must first see to one thing that can really provide the right solution for your business. Besides, if one chooses a long-term fintech solution development company, it can offer some stable products. The main reason behind it is that they have extensive experience in serving customers with fintech solutions. In addition to this, such companies also help in saving a lot of money.

2.5 Fintech Portfolio

Creating a perfect fintech app or product is not easy. Fintech is the most sensitive industry in the tech market as it directly deals with clients’ confidential data like financial statements, personal information, money, and more. Therefore, the fintech app that the software development company creates for the clients must be developed using the right terms of safety, security, functionality, and aesthetics.

And for this, every company needs to have an amazing team of fintech developers who have the expertise and experience in creating fintech products. A company with a regular fintech portfolio is not enough for businesses that outsource teams for their critical projects. Therefore, development companies must have experienced teams, and businesses who are planning to hire one such organization must see to it that the firm they choose must at least have two fintech projects in their portfolio.

2.6 Risk Management Plan

When any financial institute decides to outsource fintech software development services, it requires a high level of trust in the hired firm as the developed product will work with highly sensitive information. If any minor product malfunction is observed or any security breach is seen, there are chances of identity theft, data loss, and more. Therefore, the chosen fintech software development company must have a solid risk mitigation plan before it signs a project with you.

This clearly means that while outsourcing a fintech software development organization, one must put quality effort and hire a company that can deliver a high-quality product as per your business requirements.

2.7 Soft Skills

Soft skills are one of the most important factors that the hired fintech software development team must have. It makes the interaction between two parties easy and automatic. Basically, regardless of the fintech business model, the chosen firm must be able to offer the best technological solutions, great experience in creating reliable, sophisticated, and secure products, and the right amount of soft skills to carry out all these things smoothly by being in constant contact with the clients.

Further Reading On:

What Skills Do You Need to Develop a Fintech App?

3. Why Choose an Outsourcing Fintech Software Development Company?

Though outsourcing in the financial sector is subject to many rules and regulations, there are many financial companies in the market that prefer outsourcing their projects. And the main reason behind it is that creating a fintech app from scratch can be difficult and time-consuming. Besides, outsourcing fintech software development companies is cheaper, reliable, and faster for both fintech startups and huge enterprises. Fintech outsourcing ranges from complete technology infrastructure to creating specific modules of the app.

Some of the major benefits that fintech software outsourcing has to offer are –

- With outsourcing, the time-to-value conversion is much faster.

- Financial organizations can save a lot of money and use third-party experience & assets to adopt new technologies.

- Fintech outsourcing companies will only focus on core business activities.

- Fintech startups can easily set up their business requirements when they are dealing with outsourcing companies.

Some of the drawbacks that come with fintech software outsourcing are –

- There is a lack of transparency in outsourcing fintech software development companies.

- If the business requirements are unclear at any point, the project will get delayed.

- There is a huge risk of losing sensitive and important data.

- Lack of communication with the outsourcing team can interrupt the software development process.

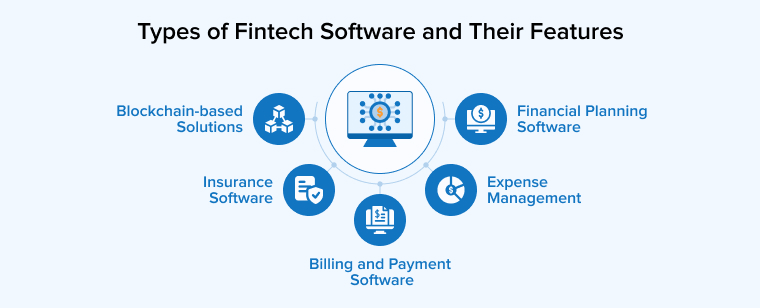

4. Types of Fintech Software and Their Features

So now you know what is fintech technology, how it is beneficial, and how choosing a reputable fintech development company can turn out your winning move. Now it’s time to focus on different fintech software development solutions that are worth taking into account.

4.1 Billing and Payment Software

Billing software is basically a tool used to automate how to generate invoices for delivered labor and products.

The smart technology enables businesses to make solicitations by using pre-done layouts which are customizable in the long run. Now, what exactly does a billing or software invoice do?

- Create and send invoices.

- Simplifies overall billing and payment.

- Easy report generation.

4.2 Expense Management

An expense management software is quite something, that means, of course, it’s a financial product where businesses can easily track different processes in regard to their employees.

Now, who uses such software?

- If you are an employee who tends to submit expenses or project hours

- If you are working as an administrator who reviews, approves, and reports on employees’ expenses.

- Bookkeepers or accountants can keep an accurate ledger

Must-have features include:

- Receipt scanning and management.

- Manual expense entry and administrative editing.

- Mobile Accessibility.

- Customizable expense approval routing.

- Expense tagging.

- Configurable expense policies.

- Basic expense reporting.

- Integration with leading 3rd-party accounting systems.

4.3 Financial Planning Software

Yes, you read it right! Gone are the days when planning your finances was all about pen-and-paper work activities. Digitalization has made maths easier. Financial planning software is a simple collection of calculators. Yes, no kidding! All your household needs can be solved easily.

4.4 Blockchain-based Solutions

Choose a fintech software development company that even offers blockchain solutions at a budget-friendly price. Now, what is the exact scope of blockchain in the financial management segment? Well, first and foremost, it could save billions in cash by reducing the processing costs.

Some of its intimidating features include:

- Single Entry Bookkeeping.

- Immutable audit trials.

- Know your customer (KYC).

- Fraud detection and reduction.

- Improved customer experience.

- Enhanced data integrity to reduce loss.

4.5 Insurance Software

Last but certainly not least is insurance software. Well, this one offers a wide range of tools to manage routine work. This one supports both clients as well as administrative ways!

For the administrative side – issuing policies, or you can manage your teams, even track claims for them, even update the policies when needed.

On the client-side – Customers can log in and conduct different tasks such as checking their updated policies, knowing when to apply for insurance, making payments online, and more.

Its types include:

- Document management software.

- Customer relationship management software.

- Insurance workflow automation software.

- Policy management software.

- Underwriting software.

- Claims management software.

- Enterprise Resource Planning software (ERP).

5. Conclusion

As seen in this blog, finding the right fintech software development company for your project is very important. The right team will help your organization in having a perfect fintech solution that can not only fulfill your business requirements but also satisfies the end-users. Besides, you can follow the above-listed points to find the well-suited fintech solution development firm.

This is a very useful article that covers all of the necessary points! But I would like to add internationalization capabilities. If a business is going to be part of global, then delivering global solutions is highly acceptable and important. This means that they need to be well-versed with different languages and regions without the help of a software programmer.