The majority of businesses prefer doing tasks on their own in order to be cost-effective. In other words, if we say that businesses are saving money so that they can invest in something more constructive and lucrative, it wouldn’t be wrong. In order to be cost-effective in the arena of accounting, companies can consider developing accounting software and there are a variety when it comes to types of accounting software.

On the whole, accounting software reduces manual work automates the accounting processes, and concurrently delivers faster efficiency, turnaround time, and accurate results. This blog will help you understand why you need accounting applications and what other ways to manage accounting software for commercial or enterprise or any other ways. To start with let’s delve into what accounting software is.

1. What is Accounting Software?

Accounting software is an integrated system and a set of apps for managing and processing financial data. Accounting Software is based on streamlining accounting functions of managing financial statements, inventory management, expense tracking, online payments, accounts payable, and accounts receivable.

These applications are used by expert accountants and bookkeeping teams to manage accounts and automate routine tasks. Some of the accounting software helps to collect accounting data, measure indicators, and report on the financial activity of the organization. It can also be used by creating a dashboard to get insights from financial data. As per the custom needs, financial software development can also be favorable in many instances. Accounting software has multiple variants which are classified below according to different ecosystem needs like commercial or enterprise or customized.

Read More – What is Accounting Software? Its Features and Benefits

2. Types of Accounting Software

To succeed at running your business or even to know if you’re succeeding, you need accounting software. Accounting software allows you to monitor the financial health of your business. Typically, it allows you to enter all expenses, such as payroll and equipment expenses, as well as income such as income from sales for businesses of all sizes. Small business accounting software is very popular because of the advantages it offers. The turnaround time is unexpectedly faster, no manual efforts in maintaining documents or papers in the drawer, and even the accuracy or reports are far better than what it was using with bill papers and binders.

There are many ways you can use accounting software, it just depends on the use and the technology that is available for use.

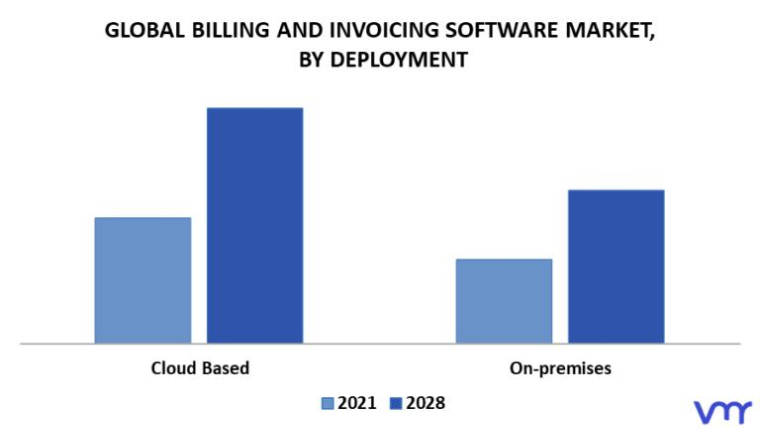

2.1 Billing and Invoicing System

One of the widely used types of accounting software is a billing and invoicing system. It is a software type that can be used by companies to record the transactions carried out by the firm. The process in this system is often carried out via ATDs (automated telephone devices), online payments, and credit card processing. Basically, this type of software helps automatically create and send invoices without any scope for human error.

Examples:

- FreshBooks

- Invoiced

- Zoho Book

2.2 Commercial Accounting Software

Accounting software may be tailored to meet your unique needs and integrates with virtually any type of organization. You’ll see graphs and infographics that summarize data, along with reports that give an overview of the health of the company and the tax forms required.

Moreover a small to medium company’s accounting needs, if not all of them, can be handled by commercial accounting software. An accounting system will enable you to create capabilities that are specifically tailored to your needs.

These software’s capabilities can be somewhat tailored to a company’s requirements. They create standard reports that may typically be tailored to the needs of the user and contain multiple layers of error detection to stop inappropriate data entry.

Examples:

- FreshBooks

- Quickbooks

- TurboCASH

2.3 Enterprise Accounting Software

Enterprise accounting software that is purely designed for Enterprise needs and majorly customized according to their needs. Such software helps manage the operational complexity that larger businesses may have. Accounting software for larger businesses might also incorporate accounting systems with additional software services including project planning, business analytics, enterprise resource planning, and workflow management.

When a large business chooses this kind of accounting software, it means that they are frequently following a multistage routine that involves asking accounting software vendors for information, seeing the product in action, and also involving other businesses. Enterprise software frequently uses relational databases rather than two-dimensional spreadsheets to display relationships between various types of data, such as the number of employees at each firm or the sales volume from all clients compared to their areas.

Examples:

- Oracle

- Intacct

- Brightpearl

2.4 Custom Accounting Software

As it goes by the name, you can create custom accounting software as per the enterprise’s needs. A company develops its own accounting application. This accounting solution frequently works well when a company wants to expand, using the skills of talented employees to design software and handle various accounting circumstances.

Eventually, accounting software works for all types of bank accounts and transactional services. Using advanced accounting functions, the company may discover its own unique accounting software with larger benefits. In other cases, a company develops its own software since no existing commercial accounting tools can satisfy its requirements.

Examples:

Spreadsheets include:

- Google Sheets

- Microsoft Excel

2.5 Cloud Accounting Software

Online accounting software can also be simply called web-based accounting software or cloud-based accounting software. Such accounting software is stored on a distant server. Data sent by users are processed in “the cloud” and then sent back to the user.

Through a cloud application service provider, businesses can use them with the internet or other networks. A business employing cloud-based accounting software can avoid setting up individual PCs with software as it gives access to every employee from anywhere anytime. Every employee in the firm can access the cloud on their own devices. This allows remote teams or branches to access the same data and the same version of the software.

Cloud-based accounting software has a lot of benefits, including that it acts like invoicing software, business intelligence, customer relationship management, data backup, and disaster recovery are typically included in your account.

Examples:

- Xero

- Netsuite

3. Which Factors Should be Considered While Choosing Accounting Software?

When it comes to choosing the right accounting software for your business, different factors need to be considered. Some of them are –

- Business Size: One of the most important things to consider is the size of the business and the number of departments your company will have. This is required as the size of your business dictates the scalability and features that will be required in accounting software.

- Integrations: You must also see if your business will easily integrate with the chosen software without affecting the data efficiency and accuracy.

- Accounting Needs: Analyzing what type of accounting approach is required by the firm like inventory management, general ledger, and more is essential.

- Budget: Accounting solutions can be available for free or can be chargeable according to your choice and the type of features the firm requires. So budget must be considered.

4. Conclusion

From this entire blog, we think accounting systems are major game-changers. The most crucial step in choosing the best accounting software for your business is to do an exhaustive task analysis that takes into consideration both managerial and financial requirements. Take your time with this important step so that it can be broad in breadth. It is impressive if unexpected growth necessitates an upgrade. However, thorough planning could enable you to delay the need to switch to new software.

Thank you for sharing this informative article on types of accounting software. For every business choosing the right accounting software is essential. There are various types of accounting software available in the market but which one is suitable for your business needs? Through this article, we can get an idea about which one is suitable for your business requirements.

Outstanding article on the many types of accounting software! I would also recommend to consider about cloud-based solutions because they provide flexibility and accessibility for remote teams. To improve productivity and streamline procedures, don't forget to give priority to software that connects effectively with other company systems. Continue posting informative stuff!

Thank you for differentiating between the types of accounting software. After reading this article, businesses can choose accounting software according to their needs. I think spreadsheets are now a traditional method of accounting software, and they will be replaced by automated accounting software.

Thanks to Tatvasoft..... this blog helped me a lot in completing my assignment.... continue to post these type of stuffs!...so good😭