The finance sector has a wide range of complex operations that are difficult to handle. Thus it requires innovative software solutions and a robust fintech strategy that can withstand the test of time.

A good fintech software development company can help you automate and simplify a significant number of business processes in the banking industry. These services enable many financial institutions to implement a variety of software solutions into their businesses that help eliminate the challenges in financial infrastructure and improve customer experience.

This article will explore the field of financial software development and how it can effectively automate your business workflows.

1. What is Financial Software Development?

The term “financial software development” refers to the process of building various types of software to help with banking, stock trading, and other common financial tasks. The goal of financial software development is to automate and improve the company’s financial operations by utilizing technological advancements like big data, artificial intelligence, and machine learning to boost productivity.

Transaction processing, investment management, asset management, risk management, loan origination, and report generation are all areas that can benefit from financial software. By automating complex operations, teams can save time and reduce errors. Plus, the built-in controls make them essential for keeping operations secure and compliant.

From front-end data processing and administration to back-end customer-facing online and mobile applications, financial software development covers a broad range. Financial software development is a complicated and comprehensive process due to the scope of the industry.

Hence, it calls for knowledgeable software engineers with a proven track record in developing, monitoring, and optimizing financial solutions for both general and specific uses. Also, thorough monitoring is required to ensure that the development process meets all industry standards for data security, regulatory compliance, and customer trust.

1.1 Benefits of Financial Software Development

Financial software development services can provide your organization with a variety of advantages such as:

1. Improved Operational Efficiency

Information management and process optimization in the era of big data and constant connectivity are both made easier with dedicated software solutions. FinTech Software allows you to connect several systems used by your business, such as online payment processing, expenditure tracking, bank reconciliation, and invoicing and billing.

These services are important, but they will become even more crucial as your company grows and the complexity of your financial data increases. Customized and scalable solutions can also be obtained through financial software development, allowing businesses to operate more efficiently.

2. Enhanced Customer Experience

Customer experience should be the top priority for financial software due to the popularity of personal finance applications and the subsequent growth in demand for user-friendly interfaces. Customer engagement and loyalty can be greatly enhanced by financial software development’s specialized services, secure transactions, and innovative software solutions.

For example, digital wallet applications provide high security and personalized promotions, and chatbots can address inquiries, provide financial advice, and simplify complicated transactions. The success of every financial institution in the current digital era depends on its ability to provide customers with a smooth and satisfying experience.

3. Enhanced Security

Cybersecurity risks have become increasingly significant in recent times. Online fraud and theft affect a large amount of data. However, such worries can be mitigated with the use of fraud detection and data analytics services. AI-powered financial software applications offer security features such as encryption, frequent backups, and multi-factor authentication. In addition, AI modules can quickly identify any suspicious or odd financial transactions or activities. This means your financial data is safer from cybercriminals and more private.

4. Scalability

The world is evolving and so will your business. So, the financial software solution must be able to handle the increasing amounts of data and money transactions without affecting its performance.

The fintech software can easily adapt and scale as per your changing business requirements. The architecture of a finance app is designed in a way that it can quickly scale the resources to keep up with your growing business without missing out on any business opportunity or driving customers away through delayed operations.

So, even if your organization expands, you can easily manage the finances without hurting the operational efficiency. Its effective data management features help streamline auditing and reporting processes.

A suitable financial software solution is scalable enough to adapt to the increasing user demands as well as new market trends. So, if the need arises, you can also update or upgrade your software to achieve sustainable business growth.

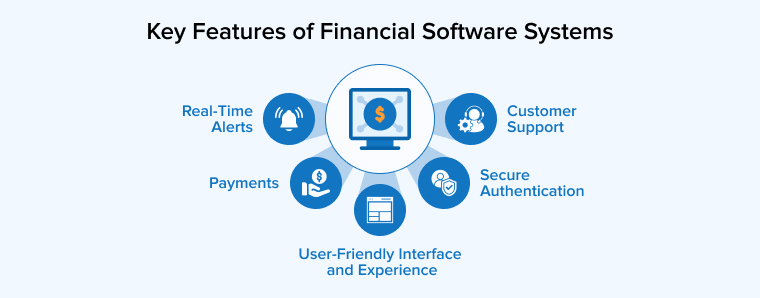

1.2 Key Features of Financial Software Systems

The ability of any fintech app to address the market’s dynamic demands and evolving trends is essential to the app’s success. A fintech app should contain the following features, selected by experts in the field.

1. Easy-to-Navigate Interface and a Pleasant User Experience

Every single financial software relies on an intuitive and easy-to-understand user interface and experience as its base. Users are more likely to abandon an app with a confusing design.

In other words, these tasks involve attracting consumers and building trust. If the software meets its users’ requirements, they are more likely to recommend it to others.

First and foremost, conversion, retention, and usability are the benefits of a design that is easy to navigate and provides an enhanced user experience.

2. Secure Authentication

A key part of every FinTech software is authorization. It is the primary approach for protecting your application with many layers of security, such as email, phone number, one-time password (OTP) based registration, biometric login, etc. To sum up, this is the part where you demonstrate to the users how well-integrated the whole experience will be, particularly in terms of security.

3. Payments

Online payment processing is the most basic and common function of any financial software. Using this function to complete transactions from various sources is now a safe and easy option. All of your financial transactions, including inquiries about past-due balances, can be easily monitored and balanced. Having the option to pay online also makes processing payments easier, reduces the risk of errors, and guarantees faster payments from everyone, at any time.

4. Real-Time Alerts

There is no certainty when it comes to the technological innovations used by scammers. If any suspicious activity or transactions occur on a user’s account, they will be notified immediately through real-time alerts and notifications. By doing so, they will be able to safeguard their accounts proactively.

In other words, clients will feel more secure and informed about the real-time warnings and notifications. This will lead to more trust, improve financial literacy, and boost user engagement.

5. Customer Support

Issues arise even in the most well-built financial applications. To make sure users have a responsive and pleasant experience, provide assistance by email, phone, and online chat.

2. How Financial Software Development Benefits the Finance Industry?

Software development plays a crucial role in the growth of financial products and the improvement of service delivery standards. From international banks and investment companies to regional accountants and insurers, everyone in the financial sector is experiencing the effects of technological advancements. Let’s discuss some of the sectors in which FinTech has contributed:

2.1 In Online Banking

Financial institutions rely on a wide range of software solutions for accounting, customer relationship management (CRM), advanced analytics, and automation of accounts payable, among other functions. In addition to targeted solutions, financial institutions are expected to witness a surge in the utilization of artificial intelligence (AI) in areas such as customer service, fraud detection, and client profiling.

2.2 In Payments

For many businesses, payment is still the most important aspect of FinTech models. Its popularity among businesses is due to the ease with which customers can make payments, create invoices, and monitor when their payments are due. The increased demand for payment solutions is understandable given their efficiency and user-friendliness.

Several financial services companies are studying common problems, such as splitting up bills and transferring money overseas, etc. One positive aspect of this sub-sector of FinTech is that it is still open to new ideas.

2.3 In Customer Finance

Expert consumer finance software can make a big difference in a user’s expenses. Users can get useful insights into money management with the help of the customer finance app, which supports monitoring, budgeting, accounting, and cost tracking. Users also have access to a dependable security system, insurance information, a variety of investment opportunities, and reliable tax advice through this platform.

2.4 In Investment Management

The use of investment management software provides a comprehensive solution for those who wish to better manage their financial assets. Investors can automate trading, monitor portfolio performance, and manage all of their investments using the software.

Both people and businesses can benefit greatly from investment management software, which offers comprehensive analytical tools and a clear view of assets. This allows for better decision-making and optimization returns.

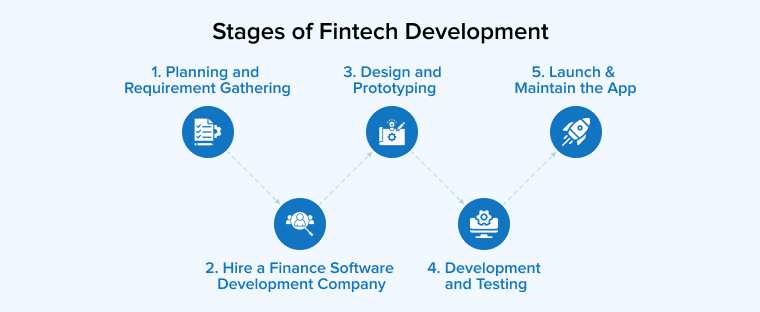

3. Stages of Fintech Development

Startups and other entrepreneurs can find FinTech app development to be a difficult task. To assist you in addressing this subject, we have outlined a detailed process for you to follow.

3.1 Planning and Requirement Gathering

A comprehensive understanding of the needs and expectations of the end users, as well as input from relevant stakeholders, is crucial at this stage. All requirements, including functional and non-functional aspects, as well as user stories and use cases, are recorded.

During the planning phase, you can also establish a development roadmap, allocate your resources effectively, and set a deadline for your project. This step ensures that the product will achieve its goals by laying the necessary groundwork for the software development process.

3.2 Hire a Finance Software Development Company

The most up-to-date technology and tools are always available to professional software development companies. They have skilled experts who have completed numerous projects and satisfied customers worldwide. In addition, they are well-versed in the many possible challenges that may arise while developing financial software. Because of this, you can trust their high-quality, custom-designed financial software. Furthermore, a professional business provides a wide range of services all in one place.

3.3 Design and Prototyping

The goal of this phase is to provide a visual representation of the software’s user interface and user experience. Designers and developers collaborate to create wireframes, mockups, and interactive prototypes according to the requirements.

To make the program easy to use and understand, this step involves defining its design, functionality, and user interface. At this stage, designers think about branding, accessibility, and usability.

A real representation of the software’s functionality, the prototype allows stakeholders to provide feedback and suggest improvements before proceeding with the development process.

3.4 Development and Testing

While creating financial software, developers define the pre-defined set of functionality. If you’re building a mobile banking app, you can collaborate with web developers for both the front end and backend, or work with developers who specialize in iOS or Android. It is the responsibility of QA engineers to work on a project from the beginning till its release. To ensure your program runs smoothly, they assess the functionality developed during each sprint. The QA team notifies the software engineers of any issues found after testing both the front-end and back-end.

3.5 Launch & Maintain The App

At this stage, the main focus is on whether the product functions as intended performs well, and keeps users happy. It resolves any errors, mistakes, or issues that may arise after the software’s installation.

The program is regularly updated and modified to make it more secure, stable, and compatible with new technologies. Users can reach out to a dedicated support team for assistance, technical guidance, and problem-solving.

Ongoing software maintenance and support ensure that the financial software is reliable, effective, and user-focused.

4. Choosing the Right Financial Software Company

The company you choose to collaborate with for financial software development solutions will significantly impact your business success. The expertise of your FinTech development partners directly correlates with the app’s quality and its preparedness for the market.

Before you choose a FinTech software development business to work with, consider the following:

4.1 Expertise

Before you choose a software development company for financial applications, ensure they have experience with the business model you intend to use. The closer their experience aligns with your company model, the better they will understand the benefits and drawbacks of becoming digital. You can double-check this by looking at reviews, case studies, and testimonies of their previous work.

4.2 Check Technical Skills

Before hiring them to build your financial technology solution, make sure they have the necessary technical knowledge.

4.3 Portfolio and Client Testimonials

One way to learn about a company’s skills, work ethic, and history is to look at its portfolio and customer testimonials. A strong portfolio will highlight the company’s expertise in the financial software industry through a number of completed projects.

Testimonials from satisfied customers are a great way to show that a business value its reputation and its clients. You can learn more about a company’s ability to provide high-quality financial software solutions that are suited to your specific requirements by reading their portfolio and customer testimonials.

4.4 Discover If They Offer Quality Assurance

To guarantee a top-notch financial solution, check that the software development company has a solid quality assurance procedure.

4.5 Support and Maintenance

To ensure that your financial software stays relevant and works properly throughout its lifetime, you need support and maintenance services. To make sure your software keeps up with the evolving demands of your organization and customers, it is important to have support and maintenance services from a dependable financial software development company. These services should include bug repairs, updates, and improvements.

Your financial software’s long-term dependability and efficiency can be guaranteed by selecting a provider that offers thorough support and maintenance services.

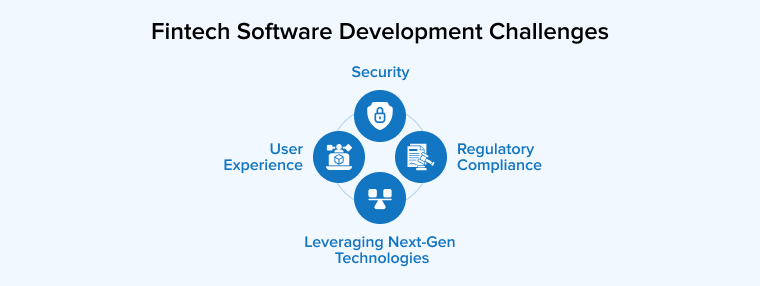

5. Fintech Software Development Challenges

Building software for the financial technology industry can be a difficult and comprehensive process that requires careful attention to detail. The following are a few challenges that developers need to tackle:

5.1 Security

Data protection strategies, user authentication procedures, and encryption protocols must be implemented by developers. Everything that is required to prevent cyber risks and unauthorized access should be taken into account.

5.2 Regulatory Compliance

Regulatory requirements related to data and privacy impact the entire financial services industry, and security needs to follow up with compliance. From user identification and privacy to data hosting and communication, there are several critical factors to consider.

Due to the complexity of the subject and the fact that laws vary from one jurisdiction to another, compliance is an important consideration when developing mobile apps. Service providers should check their legal standing, as well as the availability of authorized resources and licenses, and the details of reporting and taxes.

5.3 Leveraging Next-Gen Technologies

For any progressive FinTech company, incorporating technology such as Blockchain, IoT, AI, etc, shows strong value. However, the real difficulty is the integration of these technologies. After all, just because your company uses an AI chatbot doesn’t mean it’s an AI-powered FinTech. When it comes to software development, only a small number of in-house developers possess the specialized knowledge needed for effective technology integration.

5.4 User Experience

User experience across various platforms is an important concern. Nowadays, mobile services are in high demand. The convenience and ease of use of mobile financial services have made them popular across the world. Therefore, it is critical that your tailored financial solution is compatible with mobile devices. That is why it is crucial that the developers you choose provide high-quality UI/UX services to enhance the user experience. Developing software for the financial sector is in many ways, a challenging task. It requires an accurate assessment of several aspects.

6. Conclusion

There are many advantages for both companies and individuals in custom financial software development, which is an essential part of the modern financial sector.

We hope you have gained a better understanding of the financial industry and the role that technology plays in its advancement. You can contact us as your trusted financial software development company for assistance in the technical aspects of your idea’s implementation. Your company can gain a competitive advantage in the dynamic financial industry, enhance customer experience, and boost efficiency with the correct financial software.

FAQ

How do I become a financial software developer?

Having a bachelor’s degree, preferably in software engineering, is very desirable in this industry. Majoring in software engineering will teach you essential programming languages like C++ and Java that are majorly required for developer positions.

Which software is used in finance?

Excel, SQL, Python, and Tableau are some of the most common tools used by financial analysts. However, there are many other tools available too that mostly rely on your industry specialty and specific function within the company.

Comments

Leave a message...