The insurance industry is the one that needs a new strength. Customers want more streamlined and speedy options for purchasing necessary insurance coverage and filing claims. This may be accomplished with the use of financial software development services. In this piece, we’ll discuss the ins and outs of insurance app development for the insurance business. Keep reading!

1. What is an Insurance App?

A mobile insurance app is a kind of software specifically made for users to manage insurance contracts and settlements. Users may conveniently apply for insurance, manage their policies, file and monitor claims, and interact with their insurance companies all in one place. This type of mobile insurance app can also provide users with tailored insurance policy suggestions and informational tools.

Insurance companies opt for insurance mobile app development to improve the customer service they give, attract new customers, and boost revenue.

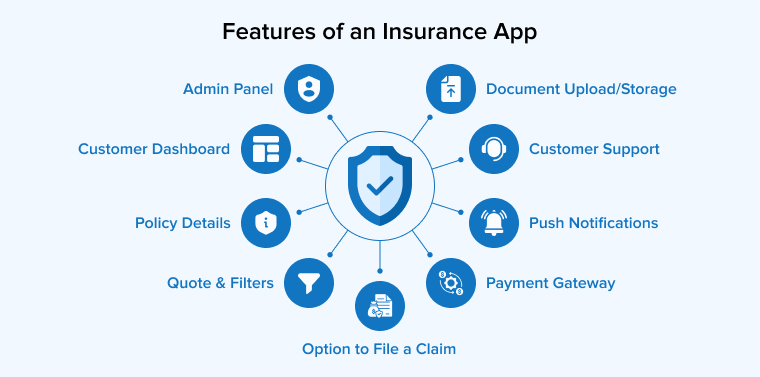

1.1 Key Features of an Insurance App

Let’s find the most important features and functionalities in an Insurance application. App stakeholders must ensure that the following entities are implemented during the app development process.

1. Admin Panel

On this main Admin page, you’ll find some general facts regarding the insurer. Make sure it’s minimal, well-organized, and features prominent calls to action. It will contain the user’s profile page which will have sections for entering vehicle details, accessing roadside help, making payments, switching plans, and more.

2. Customer Dashboard

Customers can use a self-service portal with the following features:

- Edit Your Profile: This section allows users to control their personal information, such as name and contact information as well as claims.

- Management of Policies: Insurance information, payment history, and current and historical policy documents are all presented in digital format. In addition, policyholders may utilize the insurance app to look into different options, compare costs, and choose the coverage that best fits their needs and interests.

- Premium Payment: This feature incorporates a payment gateway, allowing policyholders to settle their premiums using any of the supported ways. Here customers may also arrange for future premium payments to be automatically deducted and reminded of.

- Claim Management: This feature allows buyers to file claims and monitor their progress in real-time. In the event of an accident or home invasion, for example, they may take a snapshot and submit it along with the necessary paperwork through the app.

- Assistance: Customers may ask questions about insurance policies, payments, claims, and more directly to the support team.

3. Policy Details

The insurance, deductible, and insurance date of expiration, among other policy specifics, should all be shown to the purchaser on the insurance mobile app. This information is useful for negotiating with the insurance provider.

4. Quote & Filters

When designing an insurance app, it’s important to think about things like quotes and filters. The Quote button allows the app to access your information and provide you with a quotation for a policy or put you in touch with insurance agents. If the organization decides to build an insurance app that has access to large chunks of data, it may be able to provide discounts or additional perks to clients who often inquire about or investigate new products.

5. Option to File a Claim

The ability to submit claims using a mobile app is the most convenient aspect of an insurance policy. The software allows users to submit a claim and monitor its progress, which can reduce wait times.

6. Payment Gateway

During the construction of your general insurance app, you want to make it as easy as possible for your consumers to make payments. So it makes perfect sense to have a place where people can input their cards and set up an automatic payment option.

7. Push Notifications

You may opt to let consumers know when they have a payment due, when their policy has changed, or the status of any claims they have filed. To put it simply, it keeps people informed. Using push notifications feature, insurance apps alert customers about sales and new products they might be interested in, increasing your chances of making a profit.

8. Customer Support

Customer assistance is an integral part of any insurance application, allowing customers to speak with the insurance provider or an expert without ever leaving the app. Support methods may include real-time chatting, email, and phone calls. Having access to customer support makes it easier for people to find answers to their questions and resolve their problems. If the app provides satisfactory service, then you may have faith in its reliability.

9. Document Upload/Storage

If you create an insurance app without this feature, customers won’t be able to submit even a snapshot of their papers. The mobile app must support document upload from both local file directories and, if necessary, import from external servers, such as hosting emails.

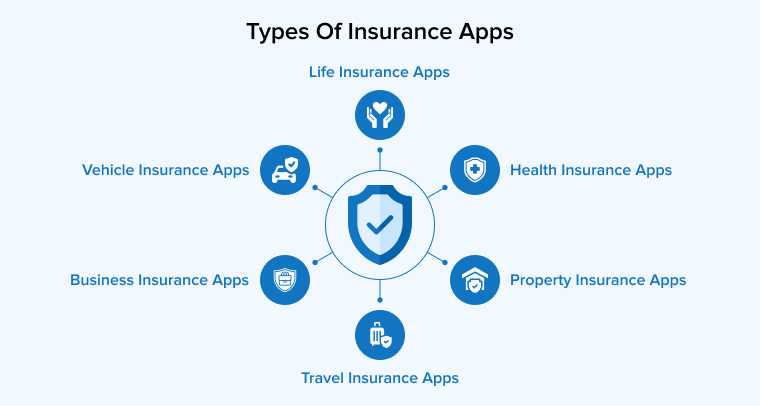

1.2 Types of Insurance Apps

Here are some types of insurance app are :

1. Vehicle Insurance Apps

When customers have been in physical harm and need to file a claim for their mobility property, a vehicle insurance mobile application like a car insurance app can work as a digital rescuer. Users can benefit from auto insurance applications by:

- Document the scene of the crash as it happens by sending in photos.

- Immediately submit a claim for the belongings.

- Learn the cost of repairs and use the associated tools.

- Put up files like photos, videos, papers, and police records that pertain to the case.

- Simple document access is provided.

2. Life Insurance Apps

Statistics show that over 50% of Americans have some sort of life insurance. The average price to create a similar, feature-rich, personalized life insurance app is around $70,000.

The functionalities of a life insurance app should be similar to those of other apps:

- Types of Policyholders

- Policy identification

- Policy applying

- In-app purchases

- Chat rooms within custom mobile apps and a few others

3. Health Insurance Apps

Medicine is a common example of a service that is covered by health plans. There are a large number of people who utilize health insurance apps. More intricate functionality is needed for such an app’s development due to the complexity of insurance plans.

A successful health insurance app will provide its intended users with helpful features. An insurance app for insured people should make it easier for them to let them:

- Find procedures and choose doctors.

- Reach practitioners and make appointments.

- Minimize documents and make it easy to access documents.

- Offered complete authority over their health.

- Include an illness checker.

- Search for insurance policies, medical professionals with the most affordable fees, and drugstores with the most affordable rates.

4. Property Insurance Apps

Property insurance might be a hassle, but with the aid of a robust mobile app, you can easily insure your home, business, art collection, jewelry, and computer equipment from anywhere.

A property insurance app offers more potential and functions than just the standard self-service options to users such as:

- Select a suitable insurance.

- Users can submit claims at the proper time.

- Regular notifications will be sent on property upkeep.

- Monitor the condition of the property for any instances of damage.

5. Travel Insurance Apps

The creation of a travel insurance application enables enterprises to provide a diverse variety of offerings to their user base, facilitating the following:

- Reduces danger in critical situations.

- Taking care of emergency medical costs.

- Pay for their healthcare costs if an accident occurs.

- Make a claim in case you lose your bags or your trip gets canceled.

- Obtain immediate international access in critical situations.

6. Business Insurance Apps

Large sums of money and considerable dangers are inherent to any corporate endeavor. As a result, many company owners value insurance for their companies. This insurance policy and its accompanying mobile app make it possible to limit financial damage caused by insured events.

An easy-to-use software for commercial insurance will facilitate the purchase of a policy and the resolution of a claim in record time. Small, medium, and big businesses may all choose an insurance plan that’s tailored to their specific set of internal and external dangers.

With business insurance apps, users can:

- Choose the appropriate insurance plan based on the dimensions of the business and the inherent level of risk.

- Effortlessly upload papers to promptly get claims for losses and instances of fraud.

- Users will be able to mitigate their financial losses by promptly resolving an insured occurrence.

1.3 Tech Stack to Develop an Insurance App

The possibilities in terms of technological stacks are practically limitless. Here’s one that’s in regular usage around here.

In addition, you may consider it to be the most effective for insurance application development:

| Type | Stack |

|---|---|

| Server | Apache, IIS |

| Hosting | AWS, Azure |

| Database | MySql, MongoDB, MS SQL and Redis |

| Backend | Node.js, Express.js, .NET Core |

| UI/UX design | Figma, Principle, and Balsamiq |

| Mobile development | MySql, MongoDB, MS SQL, and Redis |

| Management | Slack, MS Teams, Jira, and Confluence |

2. Why Does an Insurance Company Need a Mobile App?

It’s possible that both insurers and innovative insurance services startups with an eye on the competitive insurance industry would be interested in developing an insurance mobile app. And this need is readily apparent in the insurance sector for many reasons.

- Both parties stand to gain from the creation and distribution of an insurance mobile app. Agency staff and policyholders can now communicate with one another in real-time using B2C mobile insurance applications.

- One of the most effective methods to offer insurance services is through a multifunctional insurance app. In addition to optimizing support costs and reducing administrative costs, this digital tool also automates the handling of claims along with additional business jobs, improves user satisfaction, and boosts an insurance agency’s income.

- The insurance app development company is given more chances to increase sales, cut costs, and expand into adjacent markets by developing an insurance mobile app. On top of that, interacting with clients through mobile insurance apps is simple and quick.

- Users will be more engaged and happy with the digital services you provide if you employ dynamic programs to create them.

- Policyholders may remain in contact, receive on-demand insurance services, get help through live chat or a chatbot, pay quickly and easily using their mobile devices, and take advantage of self-service options when they download an insurance app.

- Accessing insurance services wherever and whenever you need them is now possible thanks to this digital technology that streamlines communication and improves efficiency.

The development of a cutting-edge insurance mobile app benefits all parties involved by offering easy access to the global insurance ecosystem with the most useful features and cutting-edge tools.

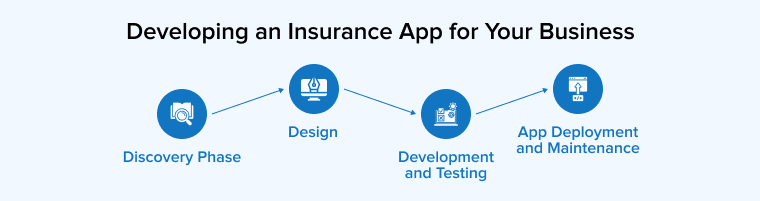

3. Developing an Insurance App for Your Business

Here are some steps to develop an insurance app for your business

3.1 Discovery Phase

In-depth research of the Insurtech industry is part of the discovery phase and helps define the entire development cycle. First, the team produces a plan outlining the steps they will take to build the app, including main features and deadlines. In short, a discovery phase consists of steps, like examining the global insurance market, the competition, and expenses.

The discovery phase’s goal is to promote mutual comprehension of project goals among team members. The main benefit of getting this data upfront is that it enables the development team to make educated decisions and create a thorough project plan that is consistent with the message of the brand.

3.2 Design

Designing an app is all about giving users a glimpse of its future functionality and aesthetic. The prototype’s design may be put to use in a number of ways, including fine-tuning user flows, guiding development, and pitching investors.

This phase is more malleable than the others since it often necessitates a rethink of the output if the startup’s goals aren’t reached. During the discovery phase, a blueprint will be created to provide insight into the corporate and technical needs of the software for the UI/UX designer.

You should have the following at the conclusion of this step:

- A comprehensive wireframe for the user experience.

- Designing user interfaces for various screen sizes and resolutions.

- A navigable prototype, or engaging design.

- A unique Figma layout file.

3.3 Insurance Application Development and Testing Phase

Use a minimum viable product (MVP) to get user feedback on your insurance business concept before investing further time and money into the insurance app development process. Draw in the first users and begin monetization after ensuring that potential and present policyholders have a requirement for the service you provide. Gather suggestions, evaluate the demand for advancements, and effectively prioritize them.

It is important to use the right strategy while creating an MVP if you want it to reflect reality. A hastily made “raw” solution will not provide enough data to verify the insurance market demand. The MVP should be developed as quickly as possible, with minimal expenditure, and only include the most essential features.

To begin designing a minimum viable product, you must first identify the most important components of your insurance app. Once policyholders begin testing the system and providing comments, the remaining features may be implemented. Building a fully functional insurance app first requires verifying the hypothesis, then handling feedback, and finally analyzing KPIs.

Developing features that aren’t essential to the product’s success and would be a waste of time and money may be avoided using the MVP development process. As a result, developing an insurance app with an MVP takes less time and costs less money.

The QA team must thoroughly evaluate the insurance app before making it available to the public to ensure accessibility, identify errors, assess connectivity, verify security, and ensure satisfaction among insurers and policyholders. While just a quarter of the total development time is spent on quality assurance, this phase is nevertheless crucial. By identifying and addressing all potential faults before releasing them to the general population, high-quality testing may help you conserve finances in the long term. On top of that, insurance app consumers want dependability and consistency, which QA provides.

3.4 App Deployment and Maintenance

The next phase involves releasing the app to major app stores like the App Store and Google Play. However, you need to start implementing and analyzing customer input shortly after the product launch.

When necessary, quick action can assure upgrades and fixes. The primary objective is to expand your user base so that you can receive more input and, in turn, enhance your insurance options and platform. Constant comments will help you identify the issues and implement improvements to your offering. This is because the more people who use your product, the more suggestions you’ll get. The more comments you leave, the better the updates will be.

4. How Much Does It Cost to Build an Insurance App?

Having an MVP ready for an insurance app might also help you attract your first customers. Building an MVP takes less time and money than starting from scratch with a full product.

We expect to start building an MVP insurance app for both iOS and Android for around $120,000. The price will go up as we add more features to the app. It will take you around five to six months to complete the minimum viable product.

In the table below, we break down the insurance app development cost :

| Development Phase | Duration (Hrs) | Expense (USD) |

|---|---|---|

| Business analysis and market research | 80+ | 3,600 |

| Prototyping and UI/UX design | 200+ | 9,900 |

| Cross platform iOS and Android mobile app | 800+ | 25,200 |

| Backend development | 900+ | 30,600 |

| Project management | 280+ | 12,600 |

| Testing | 300+ | 14,400 |

| Total | 2,500+ | 96300 |

Web applications are often simpler and less expensive to develop than mobile apps and insurance broker apps cost around as much or a little less.

5. Conclusion

Working with a seasoned financial app development services company can help your insurance mobile app development project take off. Our top-notch apps and reduced app development costs can help your company thrive.

TatvaSoft’s proficiency in application consultancy, UI/UX development, QA, and deployment ensures adaptability. We have extensive expertise in developing unique mobile apps for the worldwide insurance industry.

Please feel free to get in touch with us and ask anything related to the financial technology and insurance industries.

Comments

Leave a message...