Nowadays, the majority of mobile users regularly use online banking solutions. They also purchase goods & services using online payment systems and transfer money to others through mobile banking apps. Seeing all these things, it is quite evident that online banking has become very important in everyone’s life. Since the pandemic, people of all ages have started using digital-only banks and appreciating digital banking services. Therefore, it is not surprising that online financial services are continually growing and getting better. For digital banking transformation, financial software development firms are using the latest technologies like Cloud Computing, Robotic Process Automation, and more.

In this blog, we will have a look at the most popular digital banking trends, and see how digital banking transformation helps banks to increase their businesses and enable users to have easy access to their online bank accounts & financial services.

1. Current Digital Banking Trends

Here are some of the top trends in digital banking services-

1.1 Growth of Online Transactions

When it comes to digital banking trends, the growth of online transactions is not a new trend but it is an approach that has been significantly accelerated due to the remote mode of everything. Nowadays, people have started paying for their goods and services through digital channels to retail or e-commerce stores. When they are making such digital payments, two-factor authorization and transaction confirmation are carried out to make the mobile banking process more secure and faster. This is the only reason people choose online transactions over offline.

Besides this, people have also started to manage savings accounts and trading stocks online and this has increased the number of brokerage accounts that were opened by the users through mobile banking apps.

1.2 Personalization

Generally, when any user chooses to move from using traditional banks to digital services, they would want to get access to all their financial information that can help them make major investments or any other money-related decisions or set financial goals. One of the most popular features such digital financial services provider apps offer is Snapshot. It provides an easy-to-understand daily summary of a bank account owner’s transactions and trends that can offer personalized financial features.

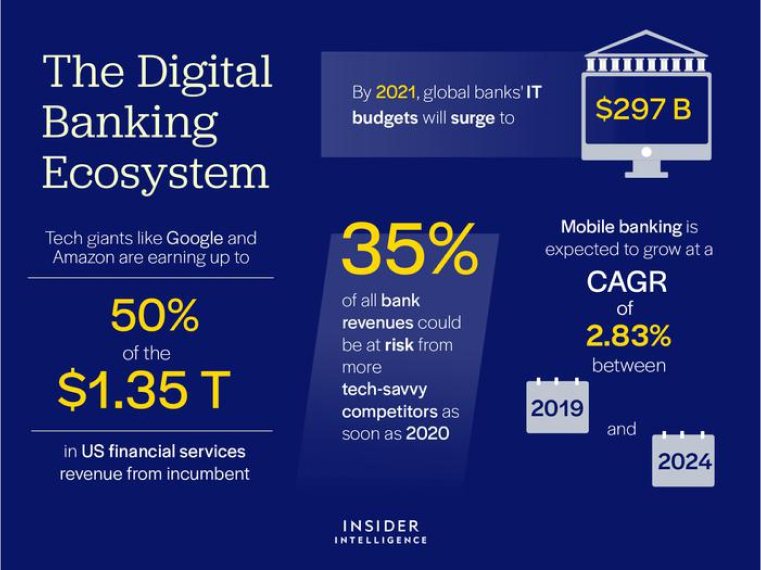

This proves that when it comes to using digital tools in the financial services industry, financial institutions can offer personalized solutions and features to users. Personalization is something that drives deeper customer engagement between digital banking products and small business owners by offering them some major appropriate steps. Customization is one of the major reasons why banks and credit unions go with the digital transformation. If they offer personalized services and tailor-made solutions to the users, staying ahead of the competition becomes easier.

1.3 Digitization

When it comes to the financial sector, traditional banks offer various financial services but they are not digital. This change accelerated when COVID hit the world. Like any other business sector, banks have also started using digital platforms. While many banks were gradually adopting digital processes, the pandemic accelerated this transition. For example, before consumers had to visit a bank branch for every simple thing like getting KYC, financial transactions, and bank statements, wealth management but now everything is digital. Now users can use mobile apps or web apps from any location to use banking facilities. This has helped fintech startups stand in this competitive world and fill the gap between financial institutions and clients.

1.4 Customer Experience is Everything!

Customers are seeking more personalized services to suit their unique requirements and tastes as digital banking continues to grow in popularity. A consistent banking experience is essential, whether customers are applying for a loan, contacting customer service, or visiting a physical location. The goal of data and analytics-driven personalization in online banking is to provide consumers with tailored offerings across all touchpoints. Building closer relationships with consumers, increasing customer loyalty, and driving profitable growth are all made possible through this.

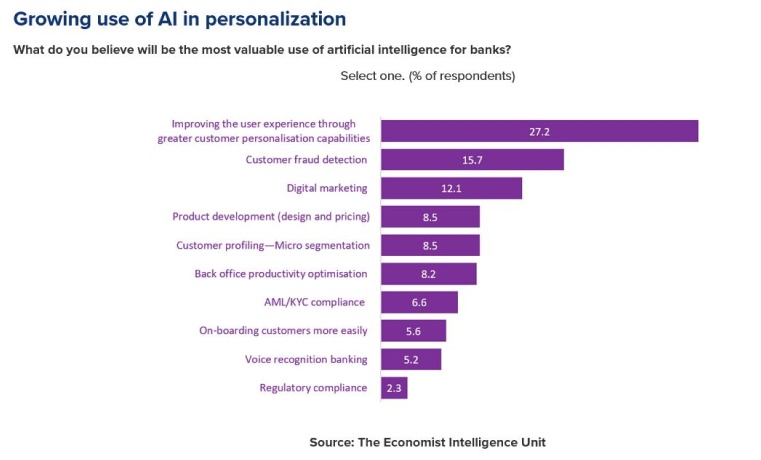

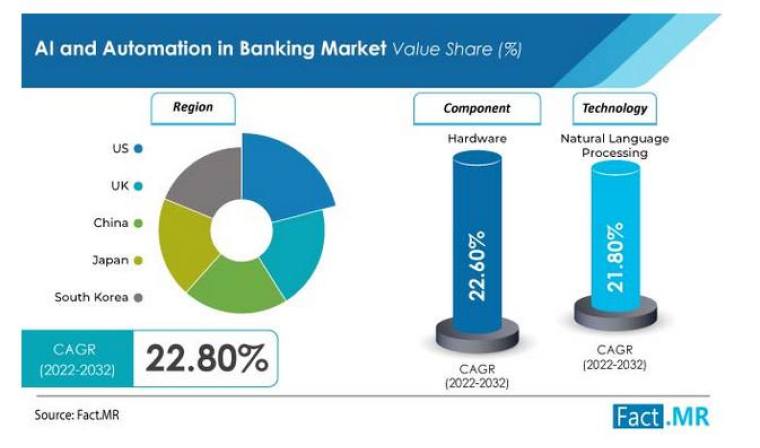

1.5 AI Providing More Targeted Services

One of the most important trends in the digital banking industry is AI. Banks have started using real-time AI-based chatbots that help them gather information about their customers and their preferences. Besides this, global financial institutions can leverage the gathered customer data and advanced analytics to offer personalized online services to clients. In addition to this, AI(Artificial Intelligence) and ML(Machine Learning) can help the banking industry understand customer expectations more quickly, identify data-backed solutions for any type of problem, develop digital transformation strategies for their business operations, and perform analysis to offer more productive & efficient solutions.

There are several uses for generative AI in the financial industry:

Assessing Potential Dangers

Data generated by AI models can mimic the behavior of actual transactions. This aids banks in improving the efficacy of system training for detecting irregularities or possible fraud.

Approval of Loans

Financial organizations can make better judgments about loan approvals with the use of generative AI models, which can forecast trustworthiness by building data models depending on the accountholder’s past.

Live Chatbots and Customer Support

Chatbots built using computational models are more sophisticated and lifelike, allowing them to communicate with users, answer their inquiries, provide account details, and even make tailored suggestions depending on user data. Because they save users time and effort while decreasing the load on operation staff, self-service technologies like these are only going to keep expanding.

Personalized Financial Services

Artificial intelligence (AI) can use consumer data and preferences to create unique financial plans and investment portfolios. Financial institutions can expand the range of services they provide by leveraging AI to provide personalized suggestions tailored to each customer’s unique requirements and objectives. Additionally, digital banks can build a stronger relationship with their accountholders through this personalized strategy.

1.6 Automation

When it comes to using digital banking solutions, customers prefer to have convenient features and banks want to avoid any kind of conflict with the clients, so they use automation tools that can offer services and solve queries 24/7. When financial institutions go through digital banking transformation and choose to offer automated services to the users this includes an auto payment system to pay bills automatically every month from your bank accounts, timely account statements, and more. Besides banking features, the application also offers 24/7 automated support to the clients through a chatbot.

1.7 Data-Driven Approach

As digital transformation initiatives are expanding, there has been a constant growth in the number of gadgets used by people. These gadgets have led to the accumulation of big data within banking solutions. In the last few years, banks have come up with smarter ways to extract meaningful information and structure data logically. This leads to the establishment of stronger customer relationships because of personalization and seamless communication.

For instance, banks can analyze customer behavior patterns as per the third-party data it has gathered from digital banking applications, ATMs, mobile apps, and call centers. This thing enables traditional banking institutions to go digital, understand the users, and help them differentiate banking offerings that need to be met every year.

1.8 Cloud Computing

Banks have started using cloud computing as it comes with unique financial features and within some time it has massively grown which has led it to be a part of the digital banking trends. Cloud computing is a very simple concept in which computing services like data warehouses, software, and networking tools are available on the Internet. Cloud computing offers some massive benefits to the banking industry and those pros are –

- Cost efficiency

- Adequate security

- Increased productivity

- Global scalability

- Speed

- Convenience

- Reliability

Besides all these benefits of cloud computing technology, it enables the banking sector to eliminate massive data silos. It also eliminates the need for physical systems, servers, and techies to manage them.

1.9 Cryptocurrency and Blockchain

As a result of advancements in blockchain technology and cryptocurrencies, consumers now have more options for banking. Bitcoin, Ethereum, and Litecoin are examples of decentralized digital currencies that function independently of central authorities.

Blockchain, also known as a distributed ledger technology, allows for transactions to be both secure and transparent. By enhancing the speed, efficiency, and safety of financial transactions, these technologies can cause a major shift in the banking business.

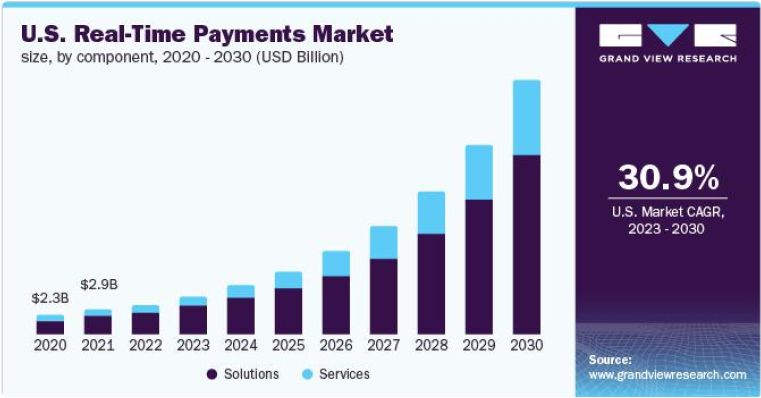

1.10 Real-Time Payments

Since COVID-19, the concept of social distancing has come into the picture and people have started using contactless payment methods to be safe. For real-time payment, customers can use applications like Chase QuickPay, GooglePay, PayPal, Paytm and more. These applications provide a seamless digital banking experience and enable the customers to make transactions across the world and this is possible because various banks have started participating in it.

1.11 Security and Privacy

Security concerns are one of the biggest concerns when it comes to the digital banking landscape. The cases of data theft, money laundering, and security breaches have increased significantly. The reason behind this is that in newer digital banking products, customers are more exposed to the threat. This is why the usage of cybersecurity concepts is becoming popular. So to ensure that the banking applications are safe and customer data is secured, banks need to invest in security, perform detailed security audits of a banking system, protect the clients from phishing, and educate clients about cybersecurity.

1.12 Usability and Intuitive Design

In a digital banking system, the intuitive graphical interface and user-friendly approach are known as the major requirements. The main reason behind this is that users prefer to have personalized mobile banking apps. Therefore, app development companies provide application programming interfaces that can enable users to understand the app very easily and help banks carry out critical operations on digital platforms seamlessly.

1.13 Mobile Banking

Managing your money has never been easier than with a mobile banking app. You can see your balance, send and receive money, pay expenses, deposit checks, and much more. You have access to almost all of your bank’s goods and services. Moreover, it’s user-friendly, so you can do things like check your bank account anytime, anywhere, as long as you have an internet connection.

You can even receive a loan, insurance, and even invest in mutual funds, fixed deposits, and more all through one app from several different banks. This eliminates the need to physically visit a branch.

However, if you have any issues or concerns with such banking services, they even provide customer care services. You can contact the customer care team through live chat, phone calls, or the app itself. Additionally, you can access a user manual for your bank’s mobile banking app on their website, just like any other customer service department.

2. Conclusion

As seen in this blog, since the pandemic, every business has started going digital to offer the best products and services to their clients in this social distancing world. And one of the fields that have adopted digitalization at its best is the banking sector. This has made customers expect banks and financial institutions to understand them, have their back, and help them out. Digital solutions of banks have started taking advantage of the latest technological trends to offer the best financial services.

FAQs

How is Digital Banking Growing?

The growing demand for delivering enhanced customer experience and increased use of cloud-based software by the banking sector & other financial institutions is the reason behind the growth of digital banking.

What is the Key Success of Digital Banking?

The key success of digital banking is characteristics like a customer-centric approach, data-driven results, and a focus on digital experience.

What is the Benefit of Digital Banking?

The major benefits of digital banking are convenience to use, an easy signing-up process, lower transaction fees, personalized features, and an anytime banking facility.

Comments

Leave a message...