Today, financial services have moved beyond traditional institutions such as banks and other lending companies. Businesses are partnering with banks and fintech software development companies to integrate financial products directly into their platforms, so customers no longer need to switch to other services to meet their financial needs. This integration has created a new revenue stream for small and medium-sized enterprises and prompted a significant change in their business models. It’s becoming a necessity rather than a choice for businesses to leverage embedded finance to its maximum potential.

This blog explores what embedded finance really means, how it works, the advantages it brings to businesses and users, and some real-world examples across industries. We’ll also take a closer look at the challenges companies may face when adopting this model and what the future holds for this fast-growing financial innovation. Let’s go deeper into how businesses integrate financial services through embedded finance and discover how it’s driving financial transformation and transforming the financial landscape.

1. What is Embedded Finance?

Embedded finance refers to the integration of financial services such as lending, payments, or insurance into non-financial products or platforms. You might have used or at least been familiar with Amazon Pay and Uber wallets for making payments after using their services. This is an example of embedded finance. These financial services are directly built into a business’s platform, so users can pay for online purchases right there, instead of leaving the page and moving to another platform.

Here is what an X user says about embedded finance.

Embedded #Finance means adding financial services like payments, loans, insurance, and asset management into products, services, or platforms that are not traditionally financial, making these services easily accessible and improving user experiences

— Digital Transformation Daily (@DigitalTDaily) July 8, 2025

RT @antgrasso pic.twitter.com/trgfFp3rqm

1.1 Benefits of Embedded Finance

Using financial services has become much easier with the emergence of embedded finance innovation. It offers multiple advantages, of which the following five are its major achievements in the finance domain:

1. Enhancing Security

Non-financial businesses offering embedded finance typically collaborate with licensed financial institutions, ensuring a high standard of security protocols. Users remain within a single platform to complete financial transactions, reducing exposure to phishing attacks or fraud from external sites.

2. Improved User Experience

The automation of financial operations on the same page not only improves the user and customer experience by making processes more convenient for customers, but also benefits third-party providers, financial institutions, and other stakeholders involved. It reduces the instances of abandoned and failed transactions, resulting in customer retention and increased conversion rates.

3. Offering Small Businesses Customer Insights

Companies offering embedded finance help small businesses transition into the digital economy by educating them about financial tools and services. These platforms often go beyond basic transactions by offering value-added features such as financial analytics, cash flow management, customer insights, and overall financial management. This helps businesses operate more efficiently and competitively in today’s digital environment.

4. BaaS Providers

Embedded finance allows Banking-as-a-Service (BaaS) providers to generate revenue through models such as transaction fees, licensing their technology, or entering into revenue-sharing partnerships. Its adaptable and scalable nature enables these providers to continuously evolve their offerings to meet changing market demands. By serving as the infrastructure behind embedded financial services, BaaS providers play a critical role in fostering innovation for both traditional banks and fintech companies.

5. Financial Inclusion and Accessibility

Embedded finance significantly contributes to financial inclusion by integrating essential financial services into everyday platforms. This approach makes it easier for underserved and unbanked populations to access tools such as credit, insurance, and savings through familiar digital environments. Rather than relying on traditional banking channels, which may be inaccessible or intimidating, users can engage with financial products directly within apps or services they already trust and use regularly. This seamless access helps bridge the gap in financial participation, empowering individuals with the resources they need to manage their finances more effectively and participate fully in the digital economy.

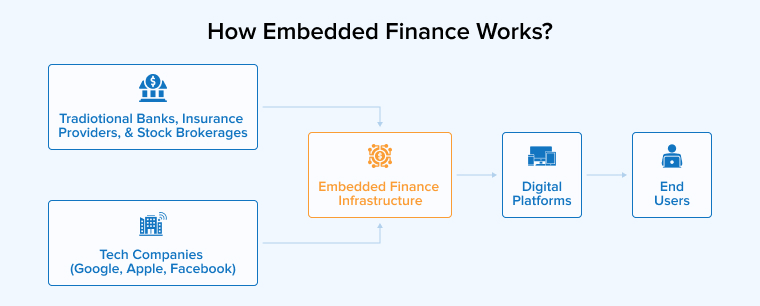

1.2 How Embedded Finance Works?

APIs are the core component that allows the integration of financial services into non-financial platforms. Companies need to invest in robust API development infrastructure to enable easy exchange of data and services between financial and non-financial platforms. You can think of APIs as a digital bridge or translator that opens new opportunities for non-financial institutions without requiring their time and resources to develop non-core functionalities and expand their businesses, while increasing user experience.

BaaS, i.e., licensed neobanks and fintech companies, provide the necessary backend infrastructure support to traditional financial and non-financial companies. They even ensure compliance with various regulatory requirements and manage risks.

1.3 Challenges of Embedded Finance

Embedded finance technology has changed the way people use financial services. Although it has increased financial accessibility and is easy to adapt, certain limitations cannot be ignored if you’re planning to implement an embedded finance strategy. So what are the significant challenges? Let’s discuss them below:

1. Data Privacy Concerns

Here, users’ sensitive financial data are saved in the platform’s database; hence, safeguarding data privacy is a high priority concern. Such platforms are quite vulnerable to cyberattacks and data breaches. Therefore, proper data-sharing agreements, encryption protocols, authentication measures, etc., must be implemented to prevent security issues.

2. API Integration

We know that embedded finance innovation is possible today due to APIs. However, interoperability challenges can arise when integrating APIs from different financial institutions, each with its own standards and protocols. Using APIs to access bank transactions may pose concerns regarding data accuracy and reliability.

3. Regulatory Compliance Complexities

The more you embed financial services like lending, payment, investment, etc., the more you inherit regulatory compliance your platform must inherit. The platform will have to comply with transparency and disclosure, data usage, customer identification, privacy protection, and many more rules, making it a cumbersome process.

2. Examples of Embedded Finance

Let’s take a look at how industries are integrating financial services into their business operations and make the most out of them:

2.1 Embedded Banking

Embedded banking is the integration of banking services and operations within non-banking applications. To achieve this, companies partner with a banking-as-a-service provider to simplify the technical and regulatory processes involved in integration. For example, Shopify Balance allows merchants to receive payments faster without needing to open a separate bank account. This increases the loyalty of store owners and service providers toward the platform by offering flexible payment options.

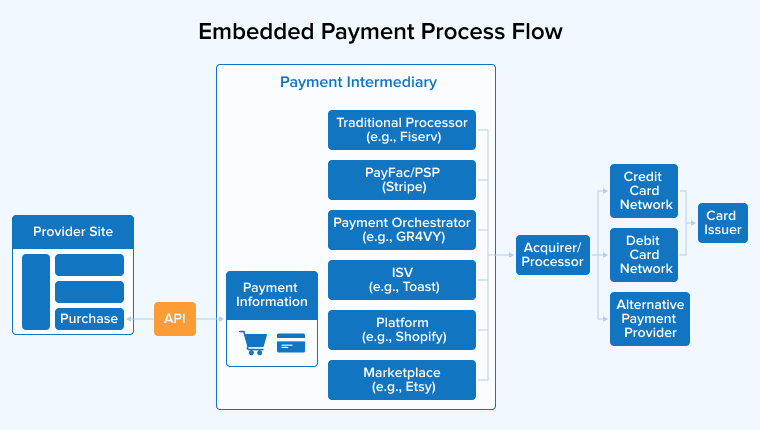

2.2 Embedded Payments

Here, the payment process is integrated into a platform, which reduces the need for cash or card management. You might have observed that if you pay through any credit or debit card on an e-commerce platform like Amazon, you get the option to save the card details. If you select this option, further orders can be placed without having to enter the same information again. It’s not just about card payments; embedded payments also facilitate payment directly through a bank account, thus saving merchants from paying a merchant discount rate (MDR) to payment processors. Integrating different payment methods on the same platform eases transaction management for businesses as well as customers.

2.3 Embedded Investments

Non-investment service providers can generate a new revenue source by integrating investment options on their platform. With rising awareness regarding SIPs and mutual funds, there is an increased use of online trading platforms.It is an application that offers embedded finance solutions, including embedded investment operations, allowing users to trade stocks, ETFs, and equities without having a brokerage account or needing an investment advisor. Banks like HSBC and Citibank offer platforms like HSBC InvestDirect and Citi Self Invest, respectively, for customers to trade stocks.

2.4 Embedded Insurance

Have you noticed the option to pay a certain amount for insurance coverage in case of mishaps while booking tickets on reservation apps like Airbnb? So now you can buy insurance when you need it without dealing with an investment company or agent. It’s become an add-on feature alongside your purchase. Today, if you take a home loan or vehicle loan, insurance coverage is often included. You do not have to go through a separate procedure to get insurance. Partnerships with fintech companies allow businesses to embed digital insurance options in a user-friendly manner.

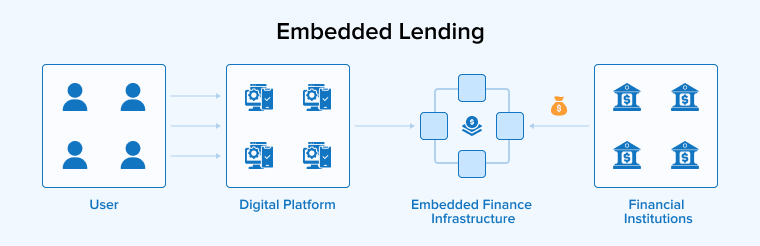

2.5 Embedded Lending

Embedded lending facility is the integration of loan and credit options into a non-lending platform, allowing users to access credit facilities without leaving the platform. The most common example of this is the “Buy now, pay later” (BNPL). BNPL is a short-term loan where, after paying the down payment, you can pay the remaining amount in installments without any interest.

3. Who is Involved in Embedded Finance Integrations?

It has become very convenient for users because they can now access an all-in-one solution for various needs. Embedding financial services enables them to book tickets, pay bills, recharge, and more with just a single app. But do you even realize how complex this easy-to-use technology is behind the scenes? There are multiple players involved who work in coordination to make this embedding work smoothly.

Below are the key institutions that come into play when dealing with embedded finance:

3.1 Fintech Companies

Fintech companies are the ones involved in the embedding process. They build APIs and software-as-a-service (Saas) solutions in partnership with embedded finance technology providers and reputed banks.

The following are the top Fintech players in embedded finance technology:

- Stripe: It embeds its payment processing services, like card payments, digital wallets, and bank transfers, in other platforms for cashless payments.

- Plaid: It’s a platform that enables users to link their bank accounts with various applications they want to use.

- Affirm: It is one of the earliest providers of “Buy now, pay later” (BNPL) services during checkout time.

3.2 Traditional Financial Institutions

Traditional financial institutions like banks, insurance companies, and investment firms are now expanding their service platforms. They are growing their customer relationship by partnering with fintech companies on non-financial platforms.

3.3 Technology Providers

They are responsible for developing the appropriate technology and infrastructure required to embed financial operations and deliver them to fintechs and banks. They simplify the embedding process by relieving banks and financial institutions from having to develop a platform themselves and manage the associated complexities. With the help of APIs, which act as plug-and-play components, any platform can integrate pre-built functionalities without investing heavily in infrastructure development. They also help banks meet changing regulatory standards related to security and fraud detection by keeping the technology up-to-date with evolving digital trends and security requirements.

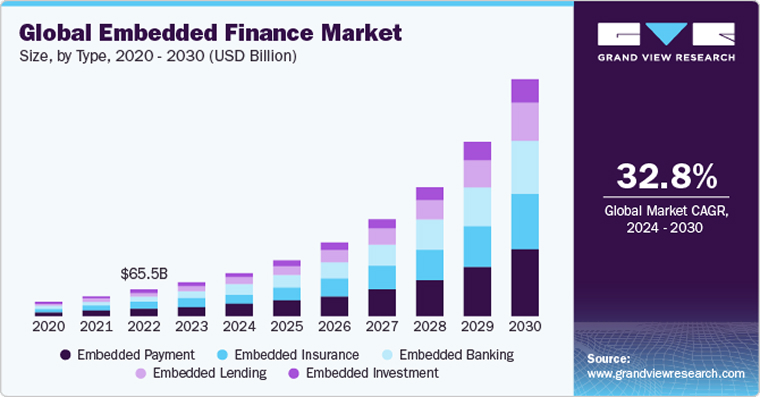

4. Future of Embedded Finance

In the coming years, we’ll witness a surge of non-financial platforms operating on par with banks and financial institutions. The competition between financial and non-financial companies will become intense, resulting in increased performance and efficiency of platforms. It’ll be compulsory for every business to integrate financial services to remain relevant to evolving requirements.

Banks will have to get used to sharing their customers with non-financial companies. We’re already witnessing the rise of various revenue streams for businesses, which is expected to expand further in the future. The coming years will be an era of partnerships between banks, fintech companies, neobanks, and technology providers.

5. Final Thoughts

Embedded finance is still in its early phase. It has much more to offer and can be implemented. It will drive major innovations in the financial sector, disrupting the traditional business model and increasing expectations for advanced and exciting solutions. Hence, businesses need to start adopting embedded finance technology to meet user expectations and demands and achieve effective results.

FAQs

What is the Difference Between Embedded Finance and Fintech?

Embedded finance is an approach that integrates financial operations within a platform, whereas fintech involves applying innovation to improve the delivery of financial services.

Why is Embedded Finance the Next Evolution in FinTech?

It’s because of eliminates the need for users to navigate to a different platform for performing financial operations.

Comments

Leave a message...