Finding the right E-commerce payment processing system is among the most crucial tasks of running an eCommerce business. The ability to accept payments from consumers via the Internet and have those funds moved to your personal bank accounts is crucial for any business looking to expand.

While it’s fascinating to launch a new online store, entrepreneurs must proceed with caution. Even if they are unaware of much about accepting credit and debit card payments online, most business owners recognize the need to have a reliable eCommerce payment processor available to their clients.

Before you opt for e-commerce development services, let’s discuss the many ways customers may pay online, with an emphasis on the most widely used payment gateways.

1. What is E-commerce Payment Processing?

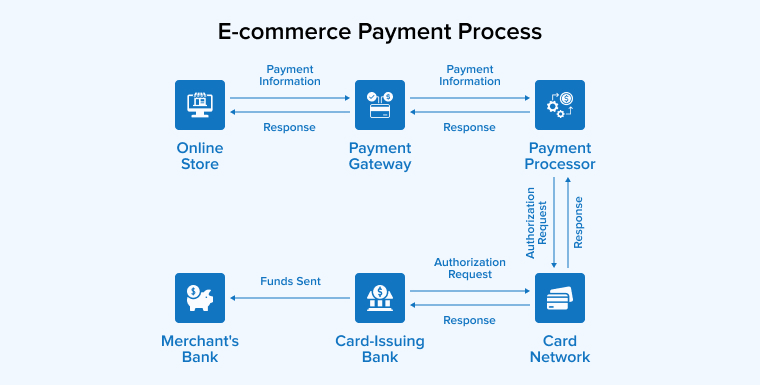

The term “e-commerce payment processing” is used to describe the infrastructure that enables online merchants to receive and process financial transactions conducted over the Internet. Authorization, collection, and settling of payments are made possible by the secure transfer of transaction data between clients, sellers, and payment service providers.

Secure payment processing, although it may take just a matter of seconds, involves several parties, including the buyer, the seller, the secure payment processor, the vendor account service, and the banks representing both the buyer and the seller.

2. How Does Ecommerce Payment Processing Work?

There are a number of moving parts on the back end of an online store’s payment system, such as payment gateways, payment processors, merchant accounts, security, fraud prevention, and regulations. Together, they assure the safety and efficacy of online financial transactions. Companies can minimize the difficulty of the online payment approach and lessen the burden on internal teams by collaborating with payment processing solution providers to combine and automate many portions of this procedure.

Some of the most important parts of accepting payments online are:

2.1 Payment Gateway

A payment gateway is a software program that links a web store’s internet page to the payment processor’s network. It ensures the safety of the buyer’s financial data throughout data entry and transmission to the payment gateway.

2.2 Payment Processor

A “payment processor” is important when it comes to receiving and processing payments online. After confirming and authorizing the payment through the customer’s banking account, it proceeds to complete the payment via the merchant’s bank in order to deposit the money.

2.3 Merchant Account

To accept payments using credit and/or debit cards, businesses must establish a merchant account. This account is often provided by a bank or merchant services provider, which makes it crucial for businesses that take online payments.

2.4 Security and Fraud Prevention

To prevent fraud and identity theft, online businesses must actively protect the financial data they use to conduct transactions. With the rise in global online e-commerce payments, there is an increasing need for trustworthy fraud detection and prevention solutions. To protect sensitive financial data and prevent fraudulent transactions, the majority of eCommerce payment processors employ technology such as tokenization and encryption.

2.5 Compliance

One of the laws controlling how payments are processed in online retailers is the Payment Card Industry Data Security Standard (PCI DSS). Payment processors are responsible for ensuring that these criteria are followed to guarantee the reliability and security of online transactions.

Interactions between the many components of e-commerce payment processing might vary depending on how an organization sets up its systems. For example, an organization may construct its payment processing system using a variety of parts, including both internally developed components and externally sourced ones.

3. E-commerce Payment Processing: Step-by-Step

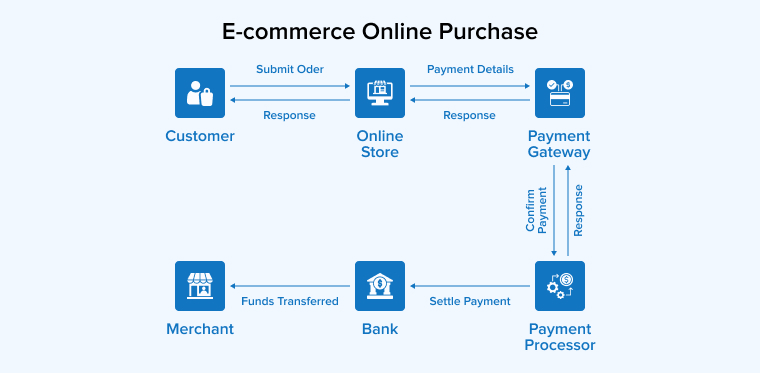

In the chain of e-commerce payment processing, the customer, the online merchant, the payment gateway, and the payment processor are all crucial players. The procedures can seem onerous at first, but they are all required to ensure secure and prompt permission, approval, and settlement of payments.

Here is how the system actively processes online purchases in detail:

- The Buyer Submits an Order: Customers shop online, make their selections, and then go through the checkout process.

- The Customer Fills Out a Payment Detail: The customer often enter their card information using the website’s integrated payment gateway when purchasing an e-commerce platform.

- Payment Authorization: The payment processor receives the data from the payment gateway and checks it with the customer’s bank or credit card holder to verify the transaction has been authorized.

- Payment Approval: The payment gateway informs the online retailer that the transaction has been permitted and confirmed by the payment processor, upon which the payment details have been validated and cleared.

- Order Confirmation: After a successful payment is made, the online store will verify the buyer’s purchase and send a confirmation email.

- Settlement: The money is sent to the seller’s bank account from the payment processor within a few business days.

- Payment Reconciliation: To ensure consistency between the order total and the payment total, the online store performs a payment reconciliation.

4. Choosing an E-commerce Payment Processor: Key Factors

When choosing an e-commerce payments provider, carefully consider your options because these e-commerce payment processing solutions are essential to giving your customers a quick and secure checkout experience.

Here are some points to consider:

- Make your payment needs clear: Consider the currencies you have to accept, the sorts of payments you would like to receive, and if you have to deal with subscriptions, recurring fees, or monthly payments.

- Consider the industries you already work in and the ones you want to grow into: Compared to global firms, companies that restrict their activities to a single jurisdiction could have fewer requirements for payment processing. You must make sure that the payment provider you choose can fulfill your needs in every regard, from national and regional payment methods to global legislation.

- Verify compliance and security: Businesses that accept credit card payments are required to comply with the PCI Data Security Standard (PCI DSS) in order to avoid identity theft and unauthorized use of credit card information. This means protecting customer data with encryption and other security measures. Using a payment processor will maintain your online business PCI compliant and may help you avoid fines.

- Analyze how simple integration is: Make sure you understand how to sign up for and connect your new e-commerce services—like hosted payment pages, integrated checkouts, and invoicing support—with your current web store.

- Consider customer support: Collaborating with a payment processor that offers prompt customer service via phone, email, or live chat is essential.

5. Top Ecommerce Payment Providers

Following are the top ecommerce payment providers:

5.1 PayPal

With PayPal’s strong infrastructure, you can easily and quickly accept credit and debit card payments from your customers. You can also offer them flexible payment options like Pay in 4 and PayPal Credit for their online purchases.

5.2 Stripe

Stripe is a flexible payment system that can be adjusted to meet your specific requirements. You can modify the application programming interface to make a payment processor that works for you. It paves the way for you to take both cash and Bitcoin as payment. Some of the top corporations in the world utilize it, and users agree that it’s a fantastic option.

5.3 Square

Square allows both online and offline markets with two-way inventory sync and delivers a full array of features that assist in managing your company and optimizing your processes, like payrolling, employee-specific controls, interactions with clients, and online invoicing at small transaction fees.

5.4 2Checkout

Compared to Stripe, 2Checkout is one of the cheaper and most widely used payment processors. They offer both managed and online shopping carts. But because the API is so complicated, it’s hard to connect to e-commerce platforms.

5.5 Authorize.net

The fact that Authorize.net protects its users’ private information so well has given it an excellent image. It gives you a lot of freedom and ease by taking a lot of different ways to pay for things online, like by phone, computer, tablet, or even a virtual point-of-sale terminal. Authorize.net can be used in most of the United States, Canada, the United Kingdom, and Australia.

6.6 Due

Due is a complete tool that makes it easier for online stores and businesses to create invoices and collect payments. It works great for freelancers, small businesses, and other businesses. It has many tools for managing projects and sending bills electronically, and time tracking is just one of them. It’s important for a lot of Internet and eCommerce companies.

5.7 Airwallex

In 2015, Melbourne was home to the launch of Airwallex, a company that specializes in international payment processing. In a matter of years, Airwallex has developed a full set of application programming interfaces (APIs) and complete solutions to assist companies in succeeding in the global market.

The platform provides, among other things, a payment gateway that facilitates international transactions for e-commerce enterprises in over 130 currencies at foreign exchange rates that are among the best in the industry.

5.8 Opayo

As the leading eCommerce payment process provider in the United Kingdom, Opayo is a top choice for online retailers looking for a reliable and secure method of accepting credit card payments from customers. Opayo is among the best eCommerce payment processing since it allows users to use any payment card with ease.

This gateway makes accepting payments online a breeze. The Opayo add-on will let your online store accept payments via PI, a server, a form, a direct connection, or even PayPal.

5.9 BlueSnap

With BlueSnap, you can allow money from any part of the world, on any gadget, and in any denomination. BlueSnap allows eCommerce businesses to permit all major credit cards in addition to local cards such as China Union Pay. The security is top-notch, and the statistics and reporting are thorough.

5.10 Amazon Pay

With Amazon Pay, the checkout process is made easier for the many millions of Amazon users who already have payment and shipping information saved in their accounts. Some companies that use Amazon Pay have seen changes in the number of sales, the number of abandoned shopping carts, and the time it takes to check out. Customers who use Amazon Pay on things that are qualified can also get the Amazon A to Z Guarantee. With a phone, it only takes a few taps to pay.

6. Conclusion

No matter how long your business has been around or if you’re just starting out, accepting payments is necessary for the process. There are many eCommerce payment companies to choose from, but it’s important to get one that works for you and your customers. One must consider the store’s bottom line, but it’s important to recognize that it is not the sole consideration. Think about what features you need right now and what features you’d like to have as your business grows.

When you choose a processing option, make sure that the digital transactions you and your clients do are easy for everyone.

FAQs

Which Payment Method is Best for E-commerce?

The most effective technique of accepting payments in an online store will vary from company to company, industry to market, and consumer demand to demand. Many people widely use online payment options such as credit cards, PayPal, Apple Pay, Google Pay, and Amazon Payments. There are perks to accepting various payment types, so it’s up to you to figure out which ones work best for your company.

What are the Types of Payment Processors?

Front-end and back-end payment processors are the two main categories.

- Front-end processors provide approval and settling services to retail banks’ merchants via their links with multiple card issuers.

- Back-end processors collect payments from front-end processors and transmit the funds from the user’s bank to the seller’s bank.

What is the Role of Payment Processing?

A payment processor receives your payment information, verifies your payment mode, and sends the mentioned amount to the seller’s account. The seller receives the money and completes the order process via e-commerce payment processing.

Comments

Leave a message...