Take any financial software solution, and you will find Python at its foundation. This programming language is so versatile that it can easily handle a myriad of financial operations, ranging from web scraping and online payment to risk management and finance forecasting. With the emergence of cutting-edge technologies like AI, ML, blockchain, cloud computing, and big data, leading finance software development companies increasingly rely on Python to build modern, complex financial modelling and data analysis solutions. This article explores the reasons behind this trend and primarily discusses various use cases of Python in finance.

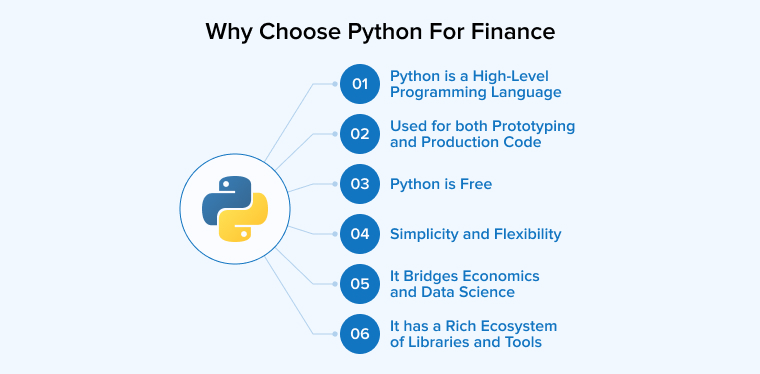

1. Why Use Python For Finance?

Python is an ideal choice for many Fintech and finance projects because of the following reasons:

1.1 Python is a High-Level Programming Language

The benefit of using a high-level programming language such as Python is that you can abstract away the system’s internal workings. For example, take memory management. When working with a low-level programming language, you must specify how to allocate, layout, and release memory in the computer, in addition to writing programs to manage these tasks. However, a high-level programming language like Python handles all these details automatically, allowing you to focus solely on your primary objectives.

Let’s see what an X user says about the Python programming language.

Python is a versatile, high-level programming language known for its simplicity and readability. It is widely used in various fields, such as web development, data science, automation, artificial intelligence, and more. Python emphasizes code readability with its clean syntax,…

— Michael Scofield (@Chandra_OG) October 17, 2024

1.2 Used for both Prototyping and Production Code

Python has a syntax similar to the English language, allowing developers to build prototypes quickly. Moreover, Python enables you to create large, production-grade applications. This is why Python is widely used for validating ideas and developing a variety of applications.

1.3 Python is Free

Being an open-source programming language, Python is available free for both personal and commercial use. This has garnered strong support from a large and vibrant community, making Python popular and widely used across the globe. Finding help or support from expert developers is easy in open-source projects. The Python developer community actively collaborates to contribute to open-source projects for the advancement of the language.

1.4 Simplicity and Flexibility

Finance apps can be incredibly complex, so you need a language that allows you to write and deploy the code easily. Python’s simple syntax accelerates development speed, helping businesses quickly launch new products into the market.

Understand the concepts of DataFrames, arrays, and other data types in Python to manage and transform financial data within an application. This approach also minimizes the error rate, which is a critical requirement in a highly regulated industry like finance.

Python is a highly versatile language that seamlessly integrates with emerging technologies to streamline and enhance the efficiency of the development process, even in dynamic industries such as finance.

Python saves your organization significant time and money by eliminating the need to build tools from scratch. It acts as a bridge between finance and cutting-edge technologies such as big data, cloud computing, and blockchain.

1.5 It Bridges Economics and Data Science

Most economists choose Python over R or MATLAB for performing calculations because it is a practical language that simplifies creating formulas and algorithms, helping them to integrate their work into Python-based platforms. You can carry out sophisticated financial calculations and present the results clearly on screen using tools like matplotlib, numpy, and SciPy.

In finance, data is often imported from various sources and formats to create a comprehensive dataset for analysis. For this, data scientists can use the pandas package and the numpy package. Python’s packages and data structures are well-suited for processing and managing large datasets.

1.6 It Has a Rich Ecosystem of Libraries and Tools

Python’s extensive ecosystem, which includes sophisticated risk management systems and complex data structures. The core capabilities of this language are essential for financial data analysis. Organizations leverage optimized Python packages to enhance their applications’ performance, especially when handling large volumes of data.

Python provides several robust data analysis libraries to process and derive insights from large datasets. Although specialized libraries such as Pandas and NumPy offer significant advantages for complex computations, they are generally less memory-efficient compared to pure Python implementations.

The comprehensive libraries available in Python serve as facilitators when FinTech products require third-party services. They enable seamless integration, access, and operation of external services. Moreover, Python has a mature ecosystem of tools whose functionalities empower businesses to create advanced risk management systems capable of evaluating complex financial data, identifying risks, and dynamically responding to market fluctuations.

Python and its ecosystem of tools and libraries are ideal for finance organizations preparing for the future. The finance industry is highly complex and constantly evolving, and Python provides the capabilities needed to adapt and grow.

2. How Python Powers the Financial Sector?

Python is a general-purpose, high-level programming language that offers robust capabilities that finance professionals can utilize in various ways, as discussed below:

2.1 Algorithmic Trading and Strategizing

Python has become a powerful tool in modern finance, especially in stock market analysis and algorithmic trading. Traders use it to analyze market data, build strategies, and test ideas before risking real money. Python can easily connect to both live and historical market data, helping analysts track price changes and market behavior in real time. It also supports automation, allowing trades to execute instantly when set conditions are met.

Built-in risk controls help limit losses and manage exposure. Data libraries simplify the process of cleaning, filtering, and organizing large financial datasets. Visualization tools transform complex numbers into clear charts that highlight trends and performance. Python also supports machine learning models that analyze company data, news, and past performance to estimate future movements.

In fast-changing markets like cryptocurrencies, Python helps monitor volatility and forecast possible price ranges. By combining analysis, automation, and prediction, Python enables more informed investment decisions in highly dynamic financial environments.

2.2 Web Scraping in Finance

Web scraping is a method of automatically collecting data from websites, documents, or online platforms. Python simplifies this process through libraries such as Beautiful Soup, Pandas, Selenium, and Requests. Analysts can extract structured data from HTML tables, PDFs, and JSON files or interact with dynamic websites that require logins or button clicks.

In finance, professionals use web scraping to gather information for due diligence, competitor analysis, pricing research, and alternative data aggregation. It helps pull company bios, M&A deals, fund performance, and investor reports quickly. Python can also connect to financial APIs such as yfinance, Alpha Vantage, or Bloomberg to fetch real-time and historical data.

Analysts integrate this data into models, dashboards, or automated alerts to track market trends, performance metrics, and risk indicators. By combining web scraping with automation, Python reduces manual work, improves accuracy, and ensures timely insights. Financial institutions, hedge funds, equity researchers, and private equity firms rely on these techniques to make smarter decisions and remain competitive in fast-moving markets.

2.3 Financial Analysis, Modeling, and Data Visualization

Python plays a central role in modern financial analysis and modeling. Finance professionals use it to handle large datasets that traditional tools struggle to manage. Python processes data quickly and integrates well with spreadsheets, APIs, and databases. Libraries like Pandas and NumPy help clean, structure, and analyze time-based financial data such as stock prices, exchange rates, and revenues.

Python programming also makes it easier to collect real-time and historical market data automatically. Visualization tools convert raw numbers into clear charts that reveal trends, risks, and opportunities. This helps decision-makers understand complex information faster. Python is especially valuable for forecasting and financial modeling. Analysts build cash flow projections, valuation models, and scenario analyses using historical data. Time-series methods help predict future performance while preserving the chronological order of the data.

Machine learning models add flexibility by including external factors like market indicators or customer behavior. Many teams combine statistical methods with machine learning approaches to achieve better results. Python also supports advanced quantitative analysis such as volatility measurement, portfolio simulations, and risk assessment. Tools like Jupyter notebooks make experimentation simple and accessible.

2.4 Risk Management Applications

Python plays an important role in financial risk management by helping teams measure, predict, and monitor risk efficiently. Analysts use it to calculate key risk metrics such as potential losses and downside exposure across different confidence levels. Python processes large time-based datasets and simulates numerous market scenarios to understand how portfolios may behave under stress. It also supports credit risk analysis by estimating default chances and potential losses for borrowers or issuers.

Machine learning models built in Python scan transaction data to detect unusual activity and reduce fraud risk. These models also help forecast future risk based on changing market conditions. Python makes it easier to analyze portfolio behavior by measuring asset correlations, volatility, and diversification effects.

Automation is another major benefit, as Python can run risk checks, update data, and test models without manual effort. Real-time systems built with Python can even adjust portfolio exposure when risk levels rise.

2.5 Development of Custom Financial Applications

Financial institutions often choose Python programming to develop software tailored to their specific needs. Developers create custom trading screens that show live prices and allow quick decision-making. Many firms also design private back-testing systems to analyze new strategies using their own detailed financial data.

Python helps teams build internal dashboards that display risk, liquidity, and performance in real-time. Managers use these tools to monitor the business and respond quickly. Large banks and hedge funds rely on Python for research, risk analysis, and trade execution. For example, J.P. Morgan Chase used Python to design flexible risk and portfolio systems. These in-house tools support innovation and enhance competitiveness.

2.6 Banking Software

Python plays a key role in modern banking and financial services beyond data analysis. Banks use it to support daily operations and improve transaction liability. Its simple structure allows teams to build secure systems for payment processing and account management. Python also powers ATM software, making withdrawals and transfers faster and more stable.

Many online banking platforms rely on Python to manage user activity and automate backend processes. Fintech companies use Python to develop digital payment solutions and mobile banking apps. Platforms like Venmo and Stripe depend on Python to handle large volumes of transactions smoothly. The language also supports fraud detection and real-time system monitoring. Due to Python’s simplicity and easy learning curve, financial institutions such as banks encourage their employees to learn it.

3. Conclusion

Python is a popular and powerful programming language with numerous applications across the finance industry, including trading, banking, and insurance. Its simple syntax and rich ecosystem make it ideal for developing tools and platforms for data analysis, financial modelling, visualization, risk management, and more. It provides libraries for every financial operation out there. Python is not just another programming language, but a technology that shouldn’t be put to use only if you are prepared to be left behind.

FAQs

Is Python a Good Skill for Finance?

Being a high-level language with simple syntax and versatile features, Python is ideal for various use cases in the finance sector, ranging from data analysis to risk management. Its rich ecosystem includes libraries suited for every type of financial operation.

What Language is Most Useful for Finance?

Python is considered the most useful programming language for the finance industry due to its versatility and data processing capabilities. However, for high-frequency trading, C++ is more effective.

Comments

Leave a message...